Fiber optic cable installers are key in our fast-paced world of telecommunications. They connect us to the future. But, they face risks too. The Allen Thomas Group offers business insurance for fiber optic cable.

They protect your project, equipment, and team from unexpected events. Their policies cover many types of fiber optic cables. This includes Corning SMF-28 and Sumitomo Electric Lightwave.

These cables are vital because of their high bandwidth and durability. The Allen Thomas Group provides many services. They help with risk management, regulatory compliance, and more. Their goal is to keep your operations running smoothly. Expert Guide Insurance provide you proper details about your insurance.

Key Takeaways

- Fiber optic cable installation insurance premiums can range from $500 to over $5,000 annually.

- General liability insurance costs for fiber optic installers can start at $400 annually for basic coverage.

- Comprehensive coverage offers broad protection, ideal for large-scale projects.

- Liability insurance protects against legal claims and is suitable for all installers.

- Customizable policies are tailored to projects with unique requirements.

Introduction to Fiber Optic Cable Installation Insurance

The world has seen a big change with fiber optic cables becoming key for internet, fast data, and phone calls. This change shows how important fiber optic installation insurance is. Setting up these cables is tricky and needs a lot of skill and money. So, fiber optic installation businesses need good insurance to avoid big losses.

The Importance of Protecting Your Fiber Optic Business

Finding the right insurance for a fiber optic installation business is a big task. Consider the necessary coverage, its price and how it matches your company. A good Insurance Plan should cover risks like damage, mistakes, and injuries. It should also be affordable.

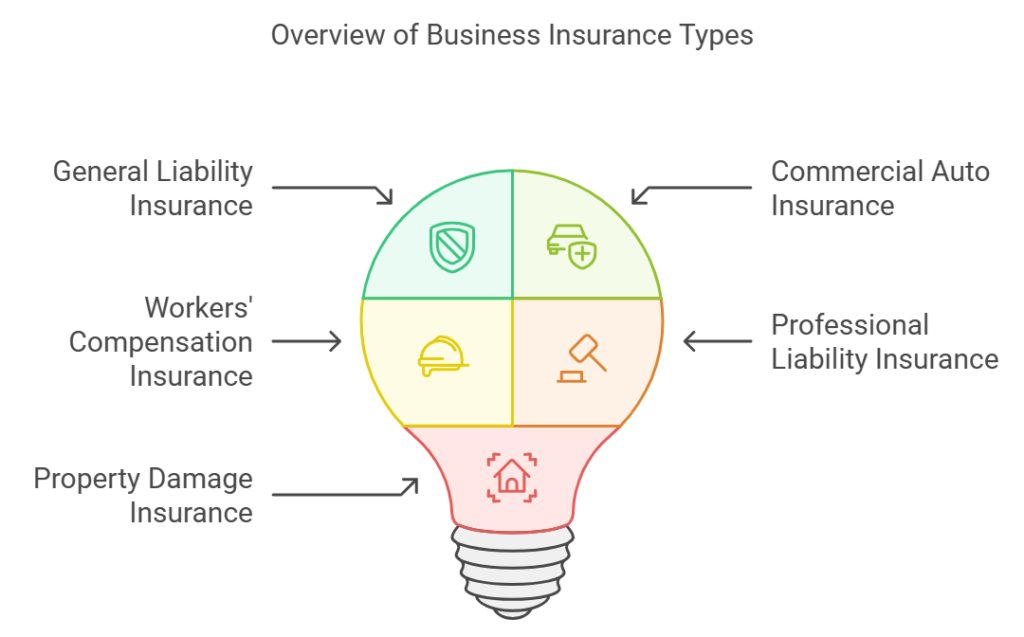

Overview of Insurance Coverage Options

- General Liability Insurance covers payment for injuries or damage to other people’s belongings or health.

- Commercial Auto Insurance safeguards against losses from theft or accidents involving business vehicles.

- Workers’ Compensation Insurance pays for medical expenses and lost wages due to work-related injuries.

- Professional Liability Insurance covers legal fees and payment related to carelessness during installations.

- Property Damage Insurance covers harm to buildings or expensive gear.

Getting the right business insurance for fiber optic cable installations is key. It helps fiber optic cable businesses stay safe, protect their money, and follow the rules. This insurance gives peace of mind and keeps businesses financially stable. It lets them focus on serving their clients well. The fiber optic cable insurance coverage is important for our lives.

Understanding the Fiber Optic Cable Installation Industry

The fiber optic cable installation industry is key for fast internet, TV, and phone services. It serves homes, businesses, and industries. These companies lay down cables that carry lots of data quickly. They work in many places, from cities to countryside, and even under the sea.

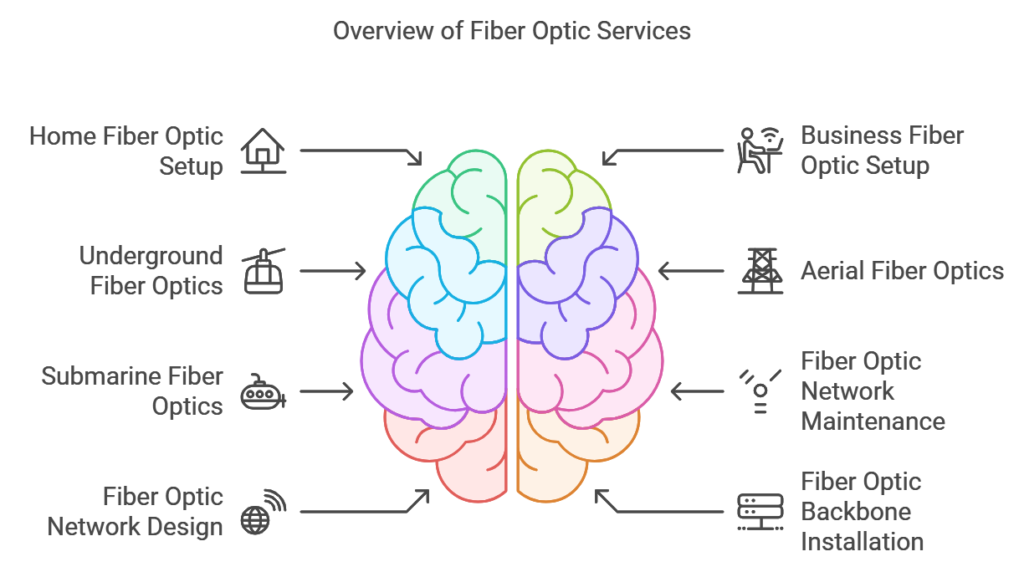

Types of Fiber Optic Cable Installation Services

Fiber optic installation companies offer many services. They meet the changing needs of their clients. Here are some main services:

- Home Fiber Optic Setup: They provide quick internet, TV, and phone services to houses and apartments.

- Business Fiber Optic Setup: They connect companies and offices to fiber networks.

- Underground Fiber Optics: They place cables in underground tubes for safety.

- Aerial Fiber Optics: They attach cables to poles where digging cannot happen.

- Submarine Fiber Optics: They position cables beneath the ocean for worldwide communication.

- Fiber Optic Network Maintenance: They keep networks working well with repairs and checks.

- Fiber Optic Network Design: They create and plan networks for improved connectivity.

- Fiber Optic Backbone Installation: They establish large networks for greater bandwidth.

- FTTH (Fiber-to-the-Home) Installations: They hook up homes directly to fiber for the fastest speeds.

- Fiber Optic Duct Installation: They set down underground ducts to guard cables.

These services are vital in today’s digital world. They help deliver fast and reliable communication and data.

Risks and Liabilities in Fiber Optic Cable Installations

Running a fiber optic installation business comes with many risks. These can affect your operations, finances, and reputation. It’s key to manage these risks well to keep your business thriving.

Property damage is a big risk. For example, accidentally cutting through underground power lines can cause big problems. It can also lead to expensive repairs. There’s also the risk of bodily injury to workers or people nearby. This is a big worry, as tools or equipment falling from heights can cause serious harm or even death.

Professional errors during installation can also cause big issues. These mistakes can lead to service outages, which can hurt your clients. Using vehicles to move workers and gear adds another risk. Vehicle accidents can cause injuries and damage to property.

| Risk | Example |

|---|---|

| Property Damage | Accidentally cutting through underground power lines, disrupting services and incurring repair costs. |

| Bodily Injury | Tools or equipment falling from a height during aerial installations, leading to severe injuries or fatalities. |

| Professional Errors | Incorrectly installing fiber optic cables, causing significant downtime for businesses or customers. |

| Vehicle Accidents | A company vehicle involved in a collision while transporting fiber optic cables, resulting in injuries and damage. |

It’s vital to understand and manage these risks. Doing so is essential for your fiber optic installation business to succeed and keep going.

General Liability Insurance for Fiber Optic Installers

A fiber optic cable installation company needs general liability insurance. This insurance guards against claims of bodily injury, property damage and other issues. For example, if you accidentally damage a customer’s property, this insurance could help cover the costs.

General liability insurance is crucial for any business, not only for fiber optic installers. It protects from losing money because of accidents. Fiber optic cable installation liability coverage is important for keeping your business secure and operating well.

| Coverage Highlights | Limits |

|---|---|

| Bodily Injury and Property Damage Liability | $1,000,000 per occurrence / $2,000,000 aggregate |

| Personal and Advertising Injury Liability | $1,000,000 per occurrence |

| Medical Payments | $10,000 per person |

Choosing the right general liability insurance for fiber optic installers is critical. Work with a provider like Wexford Insurance. They offer a tailored program for fiber optic businesses in Kansas, with certificates of insurance and claims help.

Don’t risk your fiber optic installation business to accidents or claims. Get strong general liability coverage. It will protect your company and keep your operations going, no matter what.

Professional Liability (Errors & Omissions) Coverage

Fiber optic cable workers encounter special risks and responsibilities. Professional liability insurance, also known as errors and omissions (E&O) coverage, is a critical safeguard for your business. It protects you against claims of negligence or failure to perform your professional duties properly.

This type of insurance is particularly important for fiber optic work. If an error in planning or execution of an installation project leads to a significant outage, this coverage is essential. It covers legal costs and any damages awarded. The technical precision required in your work, combined with the risk of significant financial loss if errors occur, makes this insurance a must-have for fiber optic installation companies.

“Ransomware continues to be one of the top malware threats targeting users of all types,” highlighting the importance of insurance for high-tech businesses like yours.

Professional liability insurance for fiber optic installers covers fiber optic errors and omissions. It covers legal defense, settlements and judgments. So your business is protected from the financial consequences of mistakes or oversights during the install.

By getting professional liability coverage you can focus on serving your clients. You can do this knowing your business is protected. Don’t leave your company vulnerable – explore the professional liability insurance options available to fiber optic installers and ensure your business is covered.

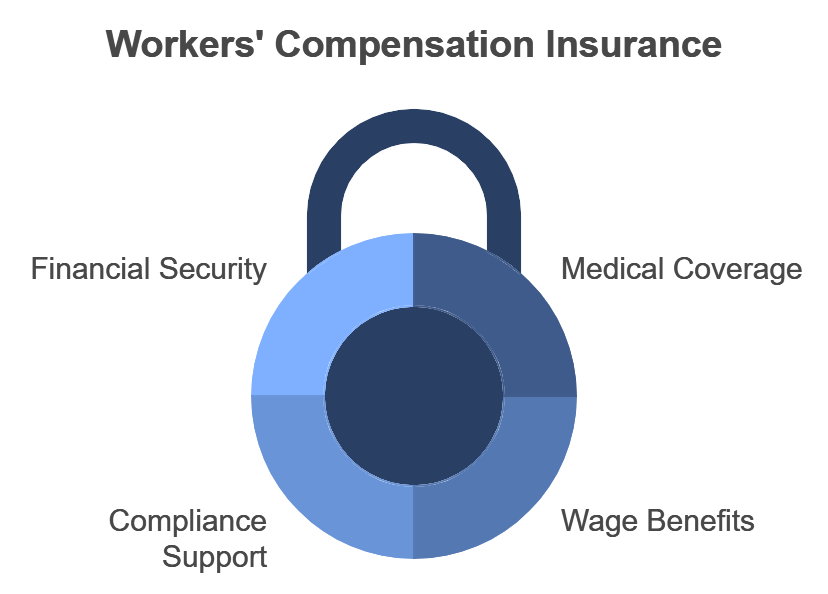

Workers’ Compensation Insurance for Installation Crews

Protecting your workers is key as a fiber optic cable installation company. Workers’ compensation insurance is vital. It gives benefits to employees hurt on the job. This is important because your work, like laying cables, can be risky.

If an employee gets injured, this insurance covers medical expenses, rehabilitation, and lost income. Workers’ compensation claims can cost more than $63,000. So, it’s a must for businesses with employees.

Getting workers’ comp coverage for cable installation crews protects your team and follows state laws. Most states require it to protect employees.

“Workers’ compensation insurance is a critical safety net for fiber optic installation companies, providing financial security for injured employees and peace of mind for business owners.”

When picking a workers’ comp policy, choose one that fits your workers’ compensation insurance for fiber optic installers. Look for quick claims handling, dedicated reps, and risk management. These help keep your work safe and costs down.

- Workers’ compensation insurance covers medical treatment for work-related injuries and illnesses

- Provides lost wage benefits for employees unable to work during recovery

- Helps businesses comply with state requirements for employee protection

- Offers financial security for your installation crews and your fiber optic business

Getting the right workers’ comp coverage for cable installation crews is vital. It protects your most important asset – your employees. By focusing on their safety, you ensure your company’s success and growth.

Commercial Auto Insurance for Fiber Optic Businesses

As a fiber optic cable installer, the right commercial auto insurance is key. It protects your vehicles and equipment when you move them to different sites. This insurance helps with repairs if your trucks or vans get damaged in an accident. It also covers any injuries or damage to property.

Protecting Vehicles and Equipment in Transit

Fiber optic cable installation means a lot of travel. Commercial auto insurance for fiber optic installers, truck and van insurance for cable installation, and transportation insurance for fiber optic projects are vital. They protect your business if there’s an accident or incident while your vehicles are moving. This insurance can cover repairs and any liability claims from accidents.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects your business from claims of bodily injury or property damage caused by your vehicles. |

| Collision Coverage | Covers the cost of repairing or replacing your vehicles if they are damaged in a collision. |

| Comprehensive Coverage | Protects your vehicles from non-collision-related damages, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if you are involved in an accident with a driver who has insufficient or no insurance. |

With a good commercial auto insurance policy, fiber optic businesses can rest easy. They know their vehicles and equipment are safe while in transit. This lets them focus on providing top-notch services to their clients.

Inland Marine Insurance for Valuable Tools and Equipment

As a fiber optic cable installer, your tools and equipment are very important for your work. You need machines for joining cables, tools for fusing them together, and vehicles to travel. These things can be stolen, damaged, or lost while you’re moving them.

Inland marine insurance is vital for your business. It protects your tools and equipment while they’re in transit or stored elsewhere. This way, you can replace lost or damaged items quickly, without halting your projects.

| Coverage Type | Description |

|---|---|

| Tool and Equipment Coverage | Protect your valuable equipment such as cable splicers, fusion splicers, testing devices, and more from theft, damage, or loss while in transit or stored at third-party locations. |

| Cargo Insurance | Insure the fiber optic cable, connectors, and other materials you transport to job sites, safeguarding your investments and ensuring timely project completion. |

| Rental Reimbursement | If your owned equipment is damaged or stolen, this coverage can help reimburse the cost of renting replacement items to keep your projects on schedule. |

Investing in inland marine insurance for fiber optic installers gives you peace of mind. Your business assets are protected, even when they’re in transit. This coverage can be a game-changer, helping you avoid disruptions and keep costs down.

When choosing insurance for your tool and equipment coverage for cable installation, look for a contractor insurance specialist. They should offer detailed policies and support for your industry’s unique risks. The right inland marine coverage protects your business and lets you focus on excellent service for your clients.

Surety Bonds and Performance Guarantees

Surety bonds and performance guarantees are key in fiber optic cable installation. They ensure the project is done right. These financial tools give the project owner confidence that the contractor will do the job.

A surety bond shows a contractor can finish a job. It ensures the project owner is covered if the contractor fails to complete the work. Surety bonds are commonly required for large projects, especially those involving the government.

A performance guarantee is the contractor’s promise to meet the project’s standards and deadlines. It gives the client peace of mind. If the contractor doesn’t meet these promises, the client can get help or compensation.

Together, surety bonds and performance guarantees create a strong safety net. They make sure the project is done right and the contractor is responsible. This gives project owners confidence in their investment.

| Type of Underground Utility Construction | Percentage of Market |

|---|---|

| Conduit Construction for Cables and Wires | 40% |

| Gas Mains or Connections | 25% |

| Water and Sewer Mains Construction | 20% |

| Electrical Operations including Fiber Optic/Communication Systems and High Tension Wire Work | 15% |

Understanding surety bonds and performance guarantees helps fiber optic installers. It makes sure their projects are done well.

Business Insurance For Fiber Optic Cable: Cost Considerations

Obtaining insurance for your fiber optic cable business can be expensive. The cost of insurance for fiber optic installers can be from $500 to over $5,000 a year. The cost varies based on the type of coverage you require, the size of your business, your location, and the level of risk involved in your work.

General liability insurance for installers can start at $400 a year for basic. But, if you need more, like professional liability and workers’ compensation, the cost goes up a lot.

But, you can save money by bundling multiple types of insurance under one policy. Additionally, numerous service providers offer the option to pay on a monthly basis. This can make it easier on your business’s budget.

| Insurance Type | Average Annual Premium Range |

|---|---|

| General Liability | $400 – $1,500 |

| Professional Liability (E&O) | $1,000 – $3,000 |

| Workers’ Compensation | $1,000 – $2,500 |

| Commercial Auto | $800 – $2,000 |

| Inland Marine | $500 – $1,500 |

It’s key to talk to your insurance provider to understand the average premiums for fiber optic cable business insurance. This way, you can get the right coverage for your business without breaking the bank.

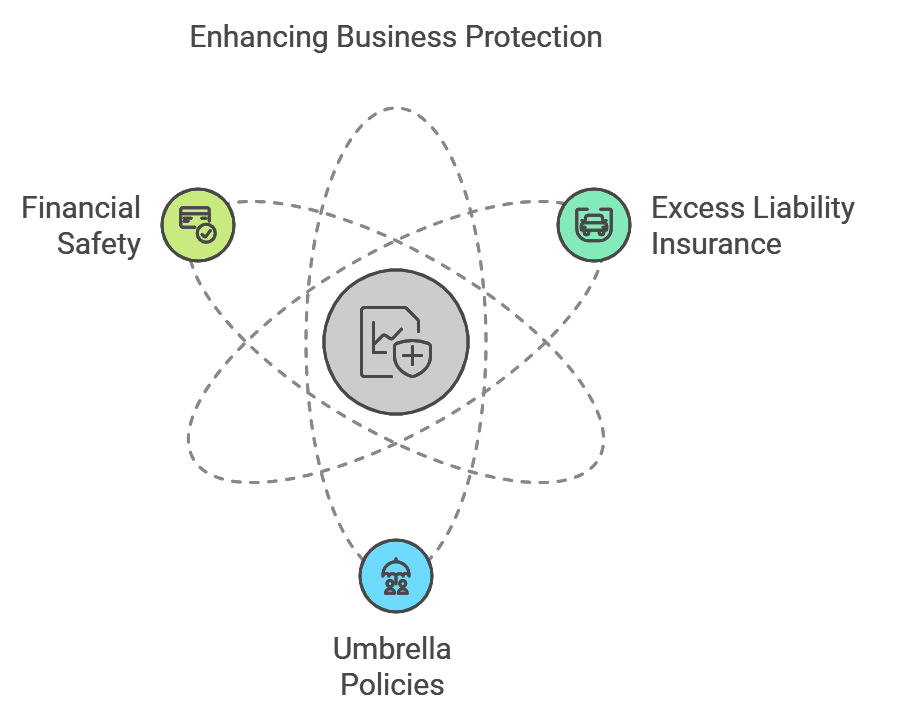

Excess Liability and Umbrella Policies

As a fiber optic installer, you may work on large projects with significant risks. Excess liability insurance and umbrella policies help protect your business from huge claims. These could cost you a lot and even bankrupt you.

Excess liability insurance adds extra protection. It covers claims that go over your general liability policy limits. This is key for fiber optic installers facing big, unexpected problems.

Umbrella policies also add more coverage. They help when claims go over your main liability policy limits. This is great for fiber optic cable installation businesses, where risks and liability can be high.

Extending Coverage for Catastrophic Claims

Excess liability insurance and umbrella policies protect your business from big claims. They give you extra coverage for unexpected, costly incidents. This way, you can handle big problems without risking your business.

- Excess liability insurance covers claims over your general liability policy limits, adding extra protection.

- Umbrella policies expand your coverage, protecting against claims over your main liability policy limits.

- These policies are key for fiber optic installers on high-value projects with big risks.

- With the right excess liability and umbrella coverage, your business is financially safe for big incidents.

Investing in excess liability insurance and umbrella policies protects your fiber optic installation business. It ensures you have the coverage needed to succeed, even with big claims.

| Coverage Type | Minimum Limits |

|---|---|

| Workers’ Compensation Insurance | Covers obligations of the proposer according to Workers’ Compensation Law |

| Liability and Property Damage Insurance | Bodily Injury Liability: $500,000 per person, $1,000,000 per occurrence Property Damage Liability: $500,000 per occurrence, $1,000,000 aggregate |

| Excess Liability or Umbrella Insurance | $10,000,000 coverage |

Regulatory Compliance and Safety Standards

Keeping up with regulatory compliance is a big challenge for fiber optic installers. They must follow FCC rules and local building codes. This ensures their work meets current and future standards.

OSHA safety standards are very important. By following OSHA-approved safety rules, installers protect their teams. This also helps lower insurance costs. Insurance companies see safety as a sign of a well-run business.

- The Construction Products Regulation (CPR) sets fire safety rules for EU and U.K. buildings.

- Starting in 2017, CPR testing classifies cables by fire reaction.

- Companies can use UL Solutions for CPR certification to make compliance easier and cheaper.

In the U.S., California is leading in broadband expansion. The California Local Permitting Playbook helps communities speed up broadband projects. It focuses on better permitting and fair access to info.

| Regulation | Key Requirement | Benefit |

|---|---|---|

| Construction Products Regulation (CPR) | Unified fire safety standards for cables in buildings | Streamlined global compliance, reduced time and costs |

| OSHA Safety Standards | Strict implementation of workplace safety protocols | Safeguarded crews, reduced insurance premiums |

| California Broadband Initiatives | Enhanced permitting processes, equitable access to information | Facilitated broadband project development |

For fiber optic installers, following safety and regulatory rules is key to success. Working with insurance providers and using industry resources helps. This way, businesses can meet these complex rules with confidence and serve their clients well.

“Staying updated with regulatory standards is a moving target for fiber optic installation businesses, yet compliance is non-negotiable.”

Risk Management Strategies for Premium Reductions

As a fiber optic installation business, you know how key risk management is. It helps keep your insurance costs down. By getting your technicians certified and using safety gear, you can lower risks. This builds a safe and professional work culture.

Doing a thorough risk assessment is vital. It looks at dangers like environmental issues, technical mistakes, and vandalism. This method helps you see and deal with problems before they happen.

Good risk management is more than just saving money. It’s about keeping your business safe for the future. By showing you care about safety and quality, you can talk down your insurance costs. This way, you keep your coverage strong while saving money.

- Invest in training programs for certifications to make sure your team is very skilled and well-informed.

- Use strong safety rules and give the right protective gear to reduce the chance of workplace accidents.

- Regularly check for and deal with potential risks, like environmental dangers, technical mistakes, and vandalism, to prevent problems before they happen.

- Maintain detailed records of your risk management efforts and safety performance to showcase your commitment to insurers.

It’s simple: fewer risks mean lower premiums. By focusing on your team, equipment, and risk strategies, you can get cheaper insurance. Plus, you keep your fiber optic business strong for the long haul.

“Effective risk management isn’t just about cutting costs—it’s about foreseeing the storm and navigating your ship safely through it.”

Conclusion

Business insurance for fiber optic cable installers are key in our fast world of telecommunications. They connect us to the future. But, they also face big risks. That’s why special insurance is there to help.

This insurance offers many benefits. It helps manage risks and follow rules. It keeps businesses running well.

Choosing the right insurance is important. It protects projects, equipment, and teams. This ensures their work keeps communities connected and thriving.

Fiber optic tech brings fast speeds and reliability. This means more jobs for skilled workers. So, having good insurance and risk plans is more important than ever.

As tech changes, installers can count on insurance to protect them. This lets them focus on their work. They can keep delivering fast, reliable connections for our future.

FAQ

What are the essential insurance policies for companies that install fiber optic cables?

Important insurance for fiber optic companies includes general liability, professional liability, workers’ compensation and commercial auto insurance. These policies guard against damage to property, injury to people, professional mistakes and vehicle accidents.

Why is general liability insurance important for fiber optic installers?

General liability insurance is key for fiber optic installers. It covers claims of bodily injury or property damage during installation. For instance, if a business harms a customer’s property, this insurance covers the cost of fixing it and any legal expenses.

How does professional liability (errors and omissions) insurance benefit fiber optic installation companies?

Professional liability insurance, or E&O coverage, protects against negligence or failure to perform duties. If an error causes a significant outage, this insurance covers legal costs and damages.

What is the importance of workers’ compensation insurance for fiber optic installation crews?

Workers’ compensation insurance is vital for fiber optic crews. It covers medical expenses, rehabilitation, and lost wages if an employee is injured while working.

Why do fiber optic installation businesses need commercial auto insurance?

Commercial auto insurance is essential for businesses that use vehicles. It covers damages and liabilities from accidents, protecting the business and its employees.

How does inland marine insurance benefit fiber optic installers?

Inland marine insurance protects against theft, damage, or loss of tools and equipment during transit. It ensures the safety of essential business assets.

What is the role of surety bonds in fiber optic installation projects?

Surety bonds guarantee project completion, essential for government contracts. They ensure the contractor fulfills their obligations and provide compensation if they fail.

How can fiber optic installation businesses manage risks to lower their insurance premiums?

By investing in technician certification and safety equipment, businesses can show their commitment to safety. This can lead to lower insurance premiums, as insurers see reduced risks.