Can Comprehensive Insurance Cover A Speaker Replacement, Yes it covers that on your policy. Comprehensive insurance protects your car from unexpected events like theft, vandalism, and natural disasters.

Ever had a car speaker go bad?You’re not alone. It’s a usual issue that might cost a lot to repair. But, your comprehensive auto insurance might help with the bill, depending on the situation.

It also covers collisions with animals. This protection often includes the vehicle itself, but may also cover costly parts like the entertainment system. Expert guide insurance provide proper details of every type of insurance.

It’s necessary to grasp what your insurance includes. Some might only protect the car’s original equipment. Others might cover upgrades or custom systems better. Always examine your policy to see what’s included.

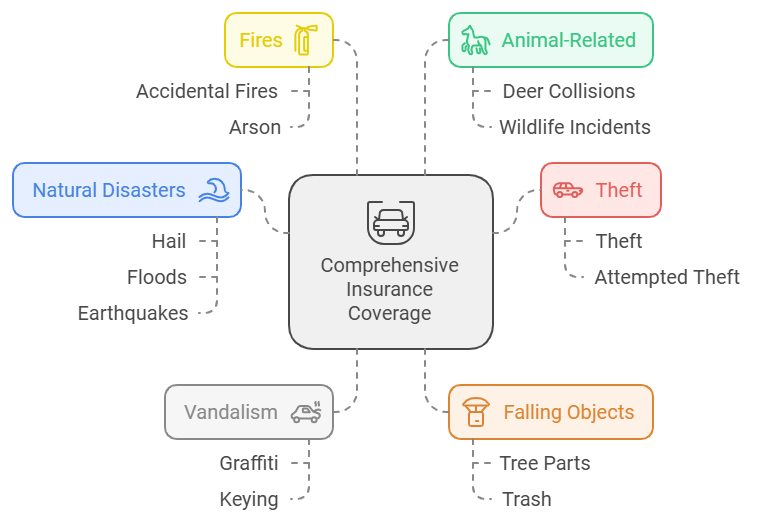

Understanding Comprehensive Auto Insurance Coverage Basics

Full comprehensive car insurance is the one that really saves the day in protecting your automobile. It includes damages not from accidents, like theft, vandalism and natural disasters. This insurance assists when your car receives damage from things not tied to collisions.

Types of Damages Covered Under Comprehensive Insurance

- Theft or attempted theft of the vehicle

- Vandalism and harmful acts

- Nature causes problems, like hail, floods or earthquakes

- Dropped things, such as tree parts or trash

- Fires, both accidental and arson-related

- Animal-related incidents, including collisions with deer or other wildlife

Standard Coverage Limitations and Exclusions

Comprehensive auto insurance coverage offers wide protectionHowever, it does not include harm from crashes or usual damage over time. Stolen personal stuff from your vehicle is protected by homeowners or renters insurance, not car insurance.

Policy Deductibles and Their Impact

The deductible you pick for your policy coverage affects how much you pay upfront for claims.A bigger deductible implies smaller monthly fees but higher costs paid by oneself. A lower deductible means higher payments but less upfront costs for vehicle audio component protection.

| Deductible Amount | Monthly Premium | Out-of-Pocket Expenses |

|---|---|---|

| $250 | $75 | $250 |

| $500 | $65 | $500 |

| $1,000 | $55 | $1,000 |

Knowing the basics of auto insurance coverage is vital. It protects your car and its important parts, like the sound system, from sudden harm.

Can Comprehensive Insurance Cover A Speaker Replacement

If your car’s audio system faces harm, you might question whether your insurance covers it. This relies on your policy and the kind of harm.

Most comprehensive insurance policies cover your car’s audio parts. This includes speakersIf theft, vandalism or a natural disaster harmed your speakers, your insurance might cover repair costs or replacement.

But, the coverage for car audio repairs or sound system damage claims can differ. If you’ve added custom audio gear, check your policy. Some policies need extra coverage for these upgrades.

Insurance policies usually have deductibles. You pay some money before your insurance starts helping. Also, there might be limits on the audio equipment covered.

“Two-thirds of smartphone users said they harmed their phones last year, leading to over $3.4 billion spent on repairs.”

To make sure your car audio repairs or sound system damage claims are covered, read your policy carefully. Or talk to your insurance provider. They can explain what’s covered and any limits or exclusions for your case.

Coverage for Aftermarket Car Audio Equipment

Insurance for your car’s audio system can be tricky, mainly with aftermarket speakers or custom setups. Unlike the factory-installed audio, which is usually covered, aftermarket gear might need extra steps or coverage.

Factory-Installed vs. Custom Audio Systems

Your standard insurance policy covers the factory audio system. But, if you’ve got aftermarket speakers or a custom sound system, you might need extra coverage. You should tell your insurance about these changes and ask about coverage for your new audio.

Documentation Requirements for Claims

When you file a claim for your audio system, you’ll need to provide detailed info. This includes model numbers, serial numbers, and proof of value. Keep all your receipts and documents ready for a claim.

Modification Impact on Insurance Coverage

Big changes to car audio can change warranty and insurance. Informing the insurance company about big upgrades is important.

| Aftermarket Audio Equipment | Factory-Installed Audio System |

|---|---|

| May require additional documentation or separate coverage | Typically covered under comprehensive auto insurance |

| Modifications can impact warranty and insurance coverage | Manufacturer’s warranty and insurance coverage typically apply |

| Insurers may require model numbers and item values for claims | Claim process is generally more straightforward |

Understand the insurance policy details, especially coverage for car audio. Discuss with your insurance company to protect custom audio against damage or theft.

Vehicle Sound System Damage Scenarios

There are many ways your vehicle sound system could get damaged. Theft, vandalism, water problems and electrical troubles are a few examples. Comprehensive insurance might help cover these problems, but what it covers depends on your policy.

Theft is a big risk for your sound system. If thieves take your stereo or speakers, insurance might help you replace them. Vandalism that harms your system could also be covered.

Water problems are also a concern, especially in places with floods. If water harms the sound system, insurance might assist with fixing or getting a new one. However, not all water problems receive coverage.

Electrical problems in your sound system can also cause issues. Insurance might not support normal wear but could assist with sudden electrical issues.

| Damage Scenario | Potential Insurance Coverage |

|---|---|

| Theft | Comprehensive insurance may cover replacement costs, subject to deductible |

| Vandalism | Comprehensive insurance may cover repair or replacement costs, subject to deductible |

| Water Damage | Comprehensive insurance may cover damage from covered events like flooding, but not all water-related incidents may be covered |

| Electrical Malfunctions | Comprehensive insurance may cover sudden and accidental electrical failures, but not general wear and tear |

Knowing about damage scenarios and insurance coverage helps protect your vehicle sound system. It also helps you avoid big car stereo replacement costs.

Filing a Claim for Car Audio System Repairs

If your car’s audio system has damage, submitting an insurance claim might cover the expenses. But, you need to document everything carefully. Here’s how to file a successful claim for your car audio repairs.

Required Documentation for Claims Process

To submit a claim, proof of the damage is necessary. This includes:

- Receipts or invoices for the original equipment or any aftermarket upgrades

- Photographs or video evidence of the damage

- A police report if the harm occurred due to stealing or deliberate harm.

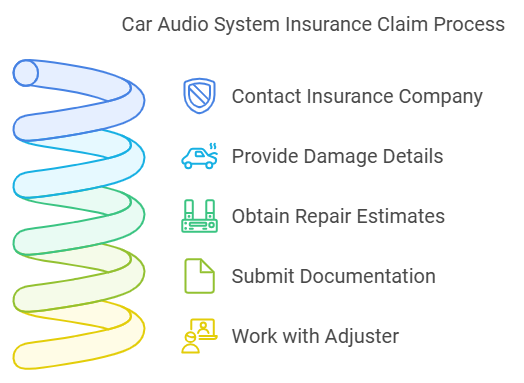

Steps to Submit an Insurance Claim

What to do for an insurance claim for car audio system repairs

- Reach out to your insurance company quickly for reporting the incident.

- Give complete details about the damage and any related costs.

- Obtain repair estimates from reputable car audio specialists

- Submit the required documentation to your insurance company

- Work with your insurance adjuster to review the claim and approve the necessary repairs

Timeline for Claim Resolution

The time needed to settle an insurance claim for car audio system repairs varies. It depends on the complexity of the case and the insurance company’s processes.

| Step | Typical Timeline |

|---|---|

| Initial Claim Submission | 1-3 business days |

| Insurance Adjuster Review | 3-10 business days |

| Approval and Payment Processing | 5-14 business days |

Knowing what documentation you need, the filing process, and the timeline can help. This way, you can get your car audio repairs claim resolved quickly and successfully.

Cost Considerations for Speaker Replacement Claims

When it comes to car stereo replacement costs, your insurance policy matters a lot. Comprehensive insurance covers many damages, but how much it covers for your car’s sound system varies.

The type of sound system in your car is key. Factory-installed speaker systems are usually covered by your insurance. They will pay for the replacement up to the original equipment’s value. But, for aftermarket or high-end custom audio systems, coverage might be less. This could mean you have to pay some of the costs yourself.

| Scenario | Comprehensive Insurance Coverage | Potential Out-of-Pocket Costs |

|---|---|---|

| Factory-installed speakers | Covered up to the value of original equipment | Deductible amount |

| Aftermarket or custom audio system | Limited coverage, may not fully reimburse replacement costs | Deductible plus any amount exceeding policy limits |

Also, the policy deductible you choose affects how much you’ll pay. A higher deductible reduces your monthly costs. However, you must pay more before insurance starts helping.

Knowing about car stereo replacement costs and comprehensive policy coverage helps you protect your car’s sound system better.

Manufacturer’s Warranty vs. Insurance Coverage

Guarding your vehicle’s audio parts is crucial. Understanding the difference between your warranty and insurance is necessary. Each offers unique benefits but also has its own limits and exclusions.

Warranty Coverage Limitations

Warranties generally cover defects for 3 to 5 years or 36,000 to 60,000 miles.. They might not cover all parts or damages from accidents, changes, or neglect. For instance, the Mopar Maximum Care Warranty doesn’t cover maintenance, glass, or certain accessories like snowplows.

Insurance Policy Overlap with Warranty

Your insurance might also protect your vehicle, even if the warranty doesn’t. Endurance’s Supreme plan covers some infotainment parts if repairs cost under $1,000. Endurance’s High Tech add-on also covers backup cameras, sensors, GPS, and more. This adds extra protection for your audio system.

Checking both your warranty and insurance policy is useful. In this way, you know what’s included and what’s not. Using both can help protect your audio system fully.

Protecting Your Car’s Audio System

Keeping your sound system safe is key, with more car audio repairs and theft happening. By being proactive, you can keep thieves away and protect your car’s audio gear.

Locking your car doors and parking in bright spots are easy steps. They make it harder for thieves to get to your car. Adding a catalytic converter cover or lock can also stop theft of this expensive part.

High-tech tracking devices are a great deterrent. They help find your car or its parts if stolen. Just pick a trusted provider for these security tools.

Noticeable anti-theft tools such as steering wheel locks or brake pedal locks also assist. They cause your vehicle to appear less attractive to robbers. These physical barriers can slow down or stop criminals, adding to your protection.

The best way to avoid car audio repairs and theft is to be proactive. By using these smart steps, you can keep your sound system safe. This way, you can enjoy your music without worrying about loss or damage.

Alternative Coverage Options for Car Audio Equipment

Comprehensive auto insurance might cover some of your car’s audio system. But, there are other ways to get better protection. Extended warranties and special insurance plans can add extra layers of coverage. They help keep your aftermarket car speakers and high-end audio gear safe.

Extended Warranty Solutions

Extended warranties such as the Mopar Maximum Care Warranty and so many others provide greater coverages than the common warranty. They cover a broader range of parts, including aftermarket car speakers. This means you get extra peace of mind for a longer time.

Specialized Audio Equipment Insurance

There are also insurance plans made just for high-end or custom car audio systems. These policies give comprehensive policy coverage against theft, damage, and more. They often cover things that regular auto insurance doesn’t.

Specialized audio equipment insurance has some great features:

- Covers accidental damage, like drops or spills

- Protects against theft or vandalism

- Replaces or fixes damaged parts, like speakers and amplifiers

- Offers flexible deductibles, starting at $29

Exploring these alternative coverage options can really protect your car audio system. It lets you enjoy your music without worry.

Conclusion

Understanding your car’s audio system protection is key when dealing with insurance. Your policy might cover some speaker replacements, but how much depends on several factors. These include the type of audio equipment, any custom changes, and your policy’s details.

To keep your car’s sound system safe, look into extra coverage like extended warranties or specialized insurance for audio gear. Also, keep records of any upgrades or changes to your vehicle. This makes filing claims easier if needed.

Being informed and proactive about your insurance can help protect your car’s sound system. This way, you can enjoy your music without worrying about unexpected costs. Taking care of your car’s audio investment is vital for its value and enjoyment.

FAQ

Does comprehensive insurance include replacing a speaker?

Whether your insurance covers speaker replacement depends on your policy. Factory-installed systems are usually covered. But, aftermarket or custom setups might need extra coverage. Check your policy or discuss with your insurer to find out what is included.

What damages are usually included under comprehensive insurance?

This insurance often covers things like theft, fire, floods, hail and animal crashes. It also includes theft of pricey parts such as airbags or catalytic converters.

What are the common coverage limits and exclusions in comprehensive insurance?

It includes theft, vandalism and natural disasters. However, it does not include everyday damage and accidents. Stolen items get covered by homeowners or renters insurance, not by car insurance.

How do policy deductibles influence your expenses when making claims?

Higher deductibles lead to lower premiums but increase your costs for claims.

How does insurance for aftermarket car audio gear compare to factory-installed systems?

Aftermarket equipment might need extra documentation or coverage. Changes to your system can affect warranty and insurance.

What common damage scenarios can occur for car audio systems?

Music systems might suffer harm due to theft, vandalism, floods or electrical problems.

What papers do you need when asking for repairs of car audio systems?

You require proof of harm, receipts for the equipment and a police report if stolen.

How can the cost of speaker replacement claims vary?

Costs vary based on equipment quality and type. Insurance might only cover factory-installed systems, leaving a gap for aftermarket ones.

How do manufacturer’s warranties and insurance coverage interact?

Warranties cover defects for a set time but have limits. Insurance might cover damages not in the warranty.

What measures can I take to protect my car’s audio system?

Lock doors, park in well-lit areas, and use visible anti-theft devices. Consider a catalytic converter cover or lock. High-tech tracking devices can help recover stolen items.

What alternative coverage options are available for car audio equipment?

Extended warranties like Mopar Maximum Care offer extra coverage. Specialized audio equipment insurance provides more coverage for high-end systems.

nice information you researched great