After massive insurance premium increases, some homeowners are trying to fight back!

Lately in Australia homeowners are dealing with rises, in home insurance rates causing lots of frustration and confusion among them. Now many homeowners are looking for ways to challenge these price hikes believing them to be too high and unfair.

The Rising Tide of Premiums

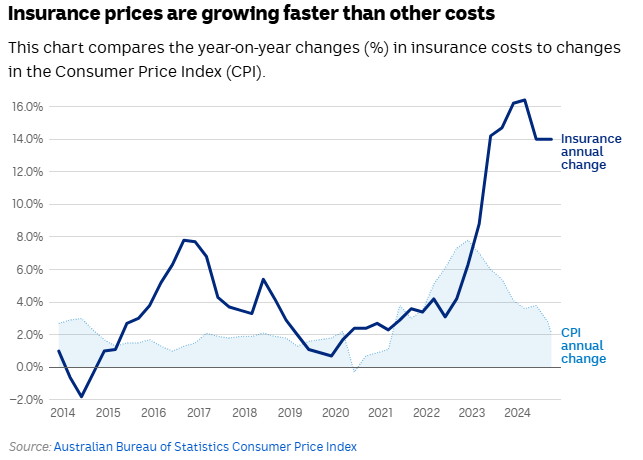

Homeowners like Warren Vant and Tiffany Cestnik have experienced staggering increases in their insurance costs, with Vant’s premium soaring by 109% and Cestnik’s by an astonishing 175%. These dramatic hikes have prompted a wave of complaints to the Australian Financial Complaints Authority (AFCA), which reported a 41% rise in disputes related to premiums and fees over the last financial year. According to the Australian Bureau of Statistics, insurance costs rose by 14% in the year leading up to September, surpassing increases in all other consumer products and services.

Factors Behind the Increases

The insurance industry attributes these rising premiums to several interrelated factors:

- Natural Disasters: Increasing frequency and severity of natural disasters are straining insurers.

- Inflation: General inflationary pressures are impacting operational costs.

- Rising Property Values: Higher home values lead to increased coverage amounts.

- Repair Costs: Escalating repair costs further contribute to premium hikes.

- Reinsurance Costs: Insurers face higher costs when obtaining reinsurance.

Despite these claims, consumer advocates argue that many homeowners feel powerless against what they perceive as unjustified price gouging. Expert Guide Insurance of John provide proper details about that how you can reduce it.

Understanding the Scale of Insurance Premium Hikes in Australia

A recent survey by CHOICE found that nine out of ten policyholders faced premium hikes, with a third reporting significant increases in their homeowners insurance costs. Recent data highlights the scale of these increases:

- In 2011, the Australian insurance industry suffered losses of about $4.3 billion from major disasters.

- Approximately 9% of homeowners in Australia lack building or contents insurance.

- About 39% of non-homeowners do not have contents insurance.

- A significant portion of households—29%—estimate their building insurance needs without proper assessment tools.

This data underscores the challenges Australian homeowners face with rising insurance premiums and raises questions about the fairness and transparency of pricing practices.

The Role of AFCA in Insurance Premium Disputes

The Australian Financial Complaints Authority (AFCA) plays a crucial role in addressing disputes between consumers and insurers. However, its ability to intervene is limited. AFCA can only investigate cases involving clear errors or misrepresentations. Emma Curtis, AFCA’s lead ombudsman, noted that while they have seen a rise in complaints, they cannot address every issue related to premium hikes.AFCA’s jurisdiction excludes many complaints about excessive premium increases, highlighting the need for stronger regulations to protect consumers and ensure affordable insurance options.

Notable Success Stories: When Homeowners Won Against Insurers

Despite the challenges, there have been instances where homeowners successfully contested significant premium hikes:

- Suncorp: After intervention from AFCA, Suncorp was compelled to cancel a proposed 60% increase in home insurance after failing to provide a valid justification.

- A&G Insurance: AFCA mandated a 39% reduction in premiums due to improper application of discounts.

These victories highlight the potential for consumers to reclaim their rights against unjustified price increases.

Calls for Increased Oversight

Consumer advocates are calling for the establishment of a national insurance price monitor to oversee general insurers’ pricing practices. This proposal aims to enhance transparency and protect consumers from unfair pricing strategies. Such a body could investigate pricing discrepancies and ensure that insurers justify their premium increases adequately.

Limitations of Current Consumer Protection Measures

While there are consumer protection measures in place within the insurance industry, they struggle to keep pace with recent premium hikes. The voluntary general insurance code of practice has been criticized for its ineffectiveness; a survey indicated that 39% of policyholders did not receive explanations for their premium increases. This lack of transparency leaves many consumers frustrated and feeling powerless against rising costs.

The Need for a National Insurance Price Monitor

The push for a national insurance price monitor has gained traction as consumer advocates highlight significant overcharges and unfair pricing practices uncovered in states like New South Wales and Victoria. Such a monitor could provide independent oversight, ensuring fair pricing practices across the industry.

How Homeowners Can Document and Challenge Excessive Premium Increases

Homeowners facing high insurance costs should take proactive steps:

- Document Your Insurance History: Keep detailed records of past premiums, claims, and any changes to your property.

- Request Explanations: Ask your insurer for clear reasons behind significant premium increases.

- File Complaints: If unsatisfied with responses from insurers, file complaints with AFCA and provide evidence of any errors or misrepresentations.

- Shop Around: Look for better insurance deals or consider raising your excess to lower premiums.

By taking action and utilizing consumer protection mechanisms, homeowners can tackle disputes over excessive premiums more effectively.

As an Australian homeowner, I’ve faced the hard truth of rising insurance costs. These costs are a big burden on our family’s budget. It makes me feel helpless and angry.

My neighbors and friends are going through the same thing. We all wonder how to fight these huge rate hikes.

Complaints about insurance to the Australian Financial Complaints Authority (AFCA) have hit a record high. Disputes over premiums and fees have jumped by 41% last year. Insurance costs have gone up by 14% in the past year, more than any other product or service.

Warren Vant and Tiffany Cestnik have seen their insurance costs jump by 109% and 175% respectively. They are demanding answers and challenging these hikes.

Many homeowners feel helpless in the face of what they see as price hikes despite these assertions made by advocates, for consumers.

Understanding the Scale of Insurance Premium Hikes in Australia

The Australian insurance market has seen big insurance premium increases recently. A CHOICE survey found nine out of ten policyholders faced premium hikes. A third of them said their homeowners insurance costs went up a lot.

Many factors are behind these high insurance premium increases. These include more natural disasters, higher home values, and rising repair costs. Homeowners are wondering why prices went up so much, even if their risks haven’t changed.

Recent data shows the size of these insurance premium increases in the Australian insurance market:

- 2011 was the worst year for the insurance industry in Australia, with losses of about $4.3 billion from major disasters.

- About 9% of homeowners in Australia don’t have building or contents insurance.

- 39% of non-homeowners in Australia don’t have contents insurance.

- 29% of households in Australia guess how much building insurance they need.

- Only 12% of households in Australia use a website calculator to figure out their insurance needs.

This data shows the big challenges Australian homeowners face with insurance premium increases. As costs go up, many are wondering if the prices are fair and clear.

| Insurer | Average Premium Increase |

|---|---|

| Suncorp | 15% |

| AAMI | 15% |

| Apia | 15% |

| GIO | 15% |

| NRMA | Over 10% |

| Coles Insurance | Over 10% |

| CGU | Over 10% |

As the Australian insurance market deals with these insurance premium increases, homeowners are looking for ways to handle their homeowners insurance costs. They want to make sure their coverage is affordable and reliable in the long run.

The Role of AFCA in Insurance Premium Disputes

The Australian Financial Complaints Authority (AFCA) is key in solving insurance premium disputes. But, it can only look into certain cases. These include wrong application, not telling the truth, breaking the law, or the insurer lying.

AFCA’s lead ombudsman, Emma Curtis, says they can’t just fix complaints about premium hikes. There must be a clear mistake, like a wrong premium calculation.

Emma Curtis notes a rise in complaints about insurance premiums. Ever so, the number of disputes has gone down after a clear ‘flood’ definition was set in 2012. Yet, different terms and definitions in policies cause confusion and underinsurance.

AFCA’s job is to check and fix these issues. They make sure consumers are treated right and insurers follow the rules. They can ask insurers to give back premiums, change policy terms, or pay out if they acted unfairly.

Even though AFCA helps a lot, it can’t change the whole insurance pricing issue. It can only deal with one case at a time. This shows we need a stronger rule to protect people and keep insurance affordable in Australia.

Notable Success Stories: When Homeowners Won Against Insurers

In Australia, some homeowners have fought back against high insurance costs and won. These insurance claim victories show that people can stand up for their consumer rights against unfair price hikes.

Recently, the Australian Financial Complaints Authority (AFCA) sided with a homeowner against Suncorp. Suncorp wanted to raise home insurance by 60%. But they couldn’t explain why, so AFCA made them cancel the increase.

A&G Insurance had to lower a premium by 39% after AFCA stepped in. Another case saw a 79% increase in personal effects coverage reduced to just 12% after a homeowner spoke out.

These insurance claim victories are rare but show that fighting back can work. They give hope to homeowners who want to protect their consumer rights and fight unfair price hikes.

| Insurer | Outcome | Reason |

|---|---|---|

| Suncorp | Forced to scrap 60% home insurance price hike | Insurer failed to justify the increase |

| A&G Insurance | Instructed to reduce premium by 39% | Failure to apply available discount |

| Unnamed Insurer | 79% increase in personal effects coverage rolled back to 12% | Homeowner successfully challenged the decision |

Why Insurance Companies Say Premiums Are Rising

Insurance companies point to several reasons for higher premiums. These include more natural disasters, inflation, and rising home values. They also mention higher repair costs and increased reinsurance costs. For example, IAG changed its pricing model, leading to a big premium increase for one policyholder.

Australian insurers have lost a lot on home insurance in the last four years. This has led to premium hikes to keep finances stable. In the US, the property and casualty insurance sector lost $26.5 billion in 2022. This jumped to $38.5 billion in 2023.

Insurance companies must keep their finances healthy to avoid rating downgrades. This could stop them from writing certain policies. Smaller claims are also raising administrative costs, making premiums go up.

Some insurers leaving the market means less competition. This leads to fewer options and possibly higher premiums. People are also more likely to claim for smaller damages, adding to the cost.

Insurers blame the rising cost of repairs and more extreme weather for premium hikes. The Midwest US is seeing more tornadoes and hailstorms. This makes it harder for insurers to keep up.

While insurers say premium hikes are needed, many homeowners are finding it hard. Some are fighting back against the insurers.

After massive insurance premium increases, some homeowners are trying to fight back

In Australia, homeowners are pushing back against huge insurance premium hikes. They want insurers to be clear about why these increases are happening. These hikes can be as high as 30% in a year.

Warren Vant and Tiffany Cestnik have taken their cases to the Australian Financial Complaints Authority (AFCA). They’re looking for fairer premiums. Others are comparing quotes to find cheaper coverage.

Consumer advocates want insurers to be more transparent about their pricing. They say homeowners are struggling financially because of these hikes. Some are even looking at other insurance options or reducing their coverage to save money.

| Claim Type | Average Claim Payout | Average Annual Rate After Claim |

|---|---|---|

| Wind | $12,913 | $2,254 |

| Liability | $31,663 | $2,286 |

| Theft | $4,646 | $2,301 |

| Fire | $83,519 | $2,299 |

The data shows that claims can lead to temporary premium hikes. The size of the increase depends on the claim type, damage, and claims history. This makes it tough for consumers to deal with the premium increase challenges.

The fight against insurance premium increase challenges is getting stronger. It’s unclear if new rules or changes will help homeowners. They want more transparency in the insurance advocacy process.

Limitations of Current Consumer Protection Measures

The insurance industry has many consumer protection measures. Yet, these safeguards struggle to keep up with the recent rise in insurance costs. The Australian Financial Complaints Authority (AFCA) helps solve disputes between consumers and insurers. But, it can’t handle many complaints about high premium increases.

The voluntary general insurance code of practice is also criticized. It requires insurers to give premium comparisons and calculations. But, a survey showed that 39% of policyholders didn’t get an explanation for their premium hikes.

Consumer advocates say the lack of access to insurers’ information is a big problem. This makes it hard for consumers to challenge premium increases. The lack of transparency and limited ways to get help leave many consumers frustrated and feeling powerless in the face of rising insurance costs.

- AFCA’s limited jurisdiction excludes many complaints about excessive insurance premium increases.

- The voluntary general insurance code of practice is ineffective, as 39% of policyholders reported receiving no explanation for premium increases.

- Consumers face a significant power imbalance due to limited access to insurers’ commercially sensitive information.

These issues highlight the need for better consumer protection. We need a more effective framework to help homeowners deal with rising insurance premiums.

The Need for a National Insurance Price Monitor

Consumer advocates want a national insurance price monitor to watch over general insurers’ prices. This idea comes from New South Wales and Victoria, where such bodies have found millions in overcharged premiums. They also uncovered unfair pricing and “loyalty taxes”.

Australians have seen huge jumps in insurance costs, with some homeowners facing up to 30% more. This has raised big worries about consumer protection and the need for government oversight in insurance.

A national insurance price monitor could be key in solving these problems. It could look into pricing, find unfair hikes, and make sure the industry is open. This would protect consumers and ensure fair insurance prices.

| Metric | Value |

|---|---|

| Premiums Recovered by NSW Monitor | Over $14 million |

| Pricing Discrepancies Uncovered | Significant |

| Loyalty Taxes Identified | Yes |

Creating a national insurance price monitor would be a big step. It would strengthen consumer protection and push for fair, clear insurance prices in Australia. This body could offer independent checks and analysis, helping to tackle the issue of skyrocketing insurance costs.

How to Document and Challenge Excessive Premium Increases

Homeowners in Australia are facing high insurance costs. Some are fighting back against insurance premium disputes. It’s important to keep a detailed record of your insurance history. This includes past premiums, claims, and any changes to your property.

Start by asking your insurer why premiums have gone up so much. If you’re not happy with their answer or think there’s been a mistake, you can complain to the Australian Financial Complaints Authority (AFCA). Make sure to give clear evidence and show how the insurer has broken your consumer rights.

Also, look for better insurance deals and think about raising your excess to lower premiums. Being proactive and using consumer protection can help reduce the financial impact of high premiums.

- Document your insurance history, including past premiums, claims, and property changes.

- Request detailed explanations from your insurer about the reasons for significant premium increases.

- If unsatisfied, file a complaint with AFCA and provide evidence of errors or misrepresentations by the insurer.

- Shop around for better insurance deals and consider raising your excess to lower premiums.

By taking action and using consumer protection, homeowners can tackle insurance premium disputes. They can fight for their consumer rights and try to lower insurance costs.

Insurance Industry Profits and Premium Correlations

The insurance industry’s profits have raised eyebrows, as homeowners face high premium rates. Data shows a worrying trend: insurance profits are up, while premiums keep going up. For example, IAG’s insurance profit rose by 79% to $1.4 billion last year, with earnings up 27%.

QBE’s average premium for customers in Australia and the Pacific went up by 12.5% last year. These big profits make people wonder if premium hikes are really needed. Or if insurers are just making more money by raising rates.

Experts say insurers might be using claim reserves to justify higher rates and lower taxes. They also point out that insurers can work together to raise rates, thanks to special laws. This means they can push up rates without facing competition.

Insurers claim they need higher rates because of “social inflation.” But there’s no real evidence of this. The industry has too much money, showing there’s no real danger that needs these rate hikes.