Did you know that almost all home inspectors deal with insurance disputes in their first year? Handling insurance problems feels challenging, but a solution exists. House inspectors for insurance rebuttal services are here to help. Expert guide insurance provide proper details for every type of insurance with experts.

7 Effective Rebuttal Strategies

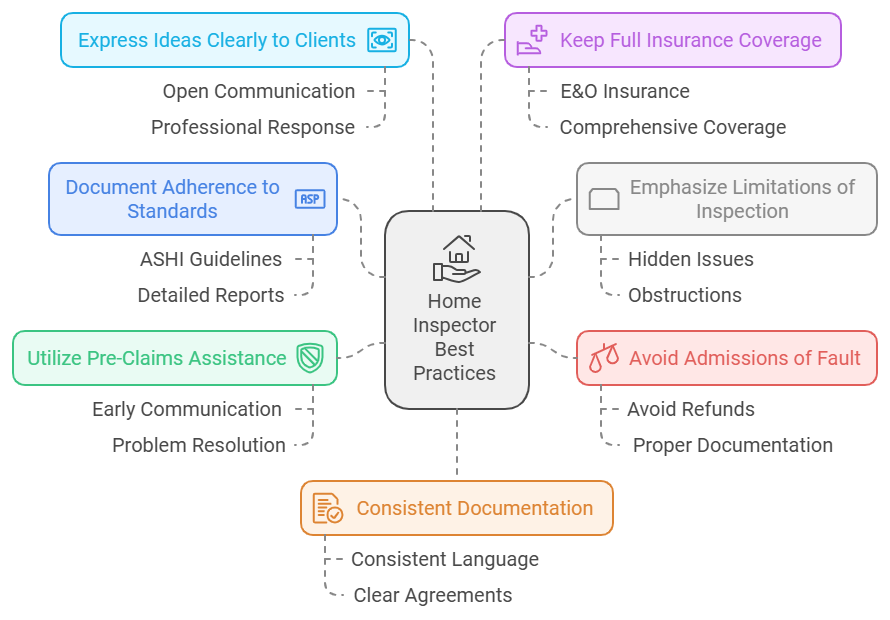

- Document Adherence to Standards:

- Clearly describe how the inspection happened according to industry rules, like those from the American Society of Home Inspectors (ASHI). This involves sharing a detailed report that notes every discovery and limit of the inspection.

- Emphasize Limitations of Inspection:

- Make it clear that inspectors cannot identify issues hidden behind walls or covered by furnishings. If visibility was obstructed by vegetation or other factors, this should be documented in the report.

- Avoid Admissions of Fault:

- Home inspectors should avoid saying things that could seem like admitting fault. For instance, offering refunds or acknowledging missed issues without proper documentation can undermine their defense.

- Utilize Pre-Claims Assistance:

- Talk to your insurance company early if a complaint appears. Early help might solve problems before turning into official claims, perhaps saving time and money.

- Express Ideas Clearly to Clients:

- Keep open communication with clients during the entire process. If clients mention worries after an inspection, react quickly and with professionalism to prevent confusion.

- Keep Full Insurance Coverage:

- Secure suitable Errors & Omissions (E&O) insurance designed for home inspectors. This coverage guards against various possible claims and gives peace of mind.

- Consistent Documentation:

- Use consistent language in both your inspection agreements and reports regarding what is included and excluded from the inspection. This clarity helps prevent disputes over perceived negligence.

These are the efective rebuttle strategies we show more with our expert in whole article how to protect your property.

This guide will show how professional home inspectors help with insurance claims. We’ll cover the rebuttal process and the legal side of disputes. Whether you’re a homeowner or an inspector, this article will give you the tools to tackle insurance challenges.

Understanding Insurance Rebuttal Services for Property Assessment

Homeowners often turn to professional home inspectors for help with insurance claims. These inspectors check the home’s condition and gather the needed documents for rebuttals. They look for structural defects and make sure the insurance company knows the home’s true value and needs.

The Role of Professional Home Inspectors

Home inspectors are trained to find any problems with a property. They check the home’s home appraisal, structural evaluation, and defect detection. This helps support insurance claims or rebuttals.

Key Components of Insurance Claims Assessment

Home inspectors are key in insurance claims assessment. They do detailed inspections and write reports on the property’s condition. This helps insurance companies understand the claim and decide on coverage and payouts.

Documentation Requirements for Rebuttals

Rebuttals need detailed documentation, like photos, videos, and written assessments. Home inspectors often provide this evidence. It’s important for challenging the insurance company’s initial assessment and ensuring fair coverage.

| Claim Dispute Scenario | Homeowner’s Perspective | Rebuild Cost Impact |

|---|---|---|

| Tricky Dick tried to raise the home insurance premium by 45% based on an overvalued assessment. | The actual square footage of the house was found to be 2,000 square feet after inspections. | The rebuild cost was reassessed to $950,000, leading to a $2,000 yearly premium. |

| The homeowner questioned a big increase in rebuild cost from $730,000 to $1,120,000. | The homeowner pointed out a discrepancy where the square footage correction was 33%, but the rebuild cost only dropped by 15%. | The disputed rebuild cost increase reflected a 32% rise in coverage, leading to a 13% premium increase over six years. |

In summary, professional home inspectors are vital in the insurance claims process. They provide the needed documentation and expertise to help homeowners. This ensures fair and accurate assessments of their properties, protecting their financial interests. 5 tips for preparing a home inscpetions.

The Process of House Inspectors for Insurance Rebuttal

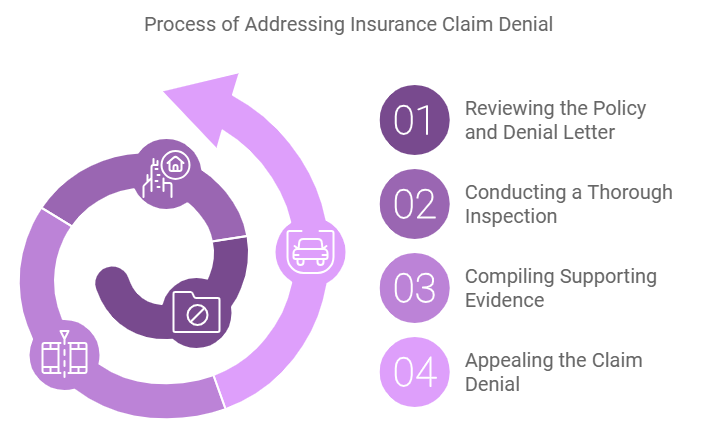

House inspectors are key in insurance claim disputes. They offer valuable assessments and help strengthen the policyholder’s case. The process involves several steps that inspectors guide through:

- Reviewing the Policy and Denial Letter: Inspectors carefully look at the policy and denial letter. This helps them understand why the claim was rejected.

- Conducting a Thorough Inspection: They do a detailed check of the property. They assess the damage and document their findings. This is important for providing support.

- Compiling Supporting Evidence: Based on their inspection, they collect evidence like photos and videos. This evidence is key for a strong case.

- Appealing the Claim Denial: With the inspector’s help, the policyholder can appeal the decision. Possibly involve speaking with the adjuster or sending an appeal to the state.

With a house inspector’s help, policyholders can fight an insurance claim denial. They might receive the coverage they deserve.

| Key Factors | Importance |

|---|---|

| Detailed Inspection | Crucial for understanding the full extent of the damage and providing underwriting support. |

| Comprehensive Documentation | Essential for building a strong, evidence-based case against the insurance company’s decision. |

| Expert Testimony | Invaluable for strengthening the policyholder’s appeal and increasing the chances of a successful rebuttal. |

“House inspectors’ knowledge is important for guiding policyholders through the insurance claims steps. They ensure they get the coverage they are entitled to.”

Expert Qualifications and Certification Requirements

To be trusted, house inspectors for insurance rebuttals must meet certain standards. These include licensing, joining professional groups, and ongoing learning. Every state has different rules, yet some are usual.

State-Specific Licensing Needs

In numerous areas, house inspectors require a license to operate. To get one, they must finish approved courses, pass tests, and keep learning. These steps ensure they know how to spot problems and assess properties well.

Professional Associations and Memberships

Good inspectors join top groups like the International Association of Certified Home Inspectors (InterNACHI). These groups offer training, ethics, and updates on construction deficiencies and property assessment. Being part of these shows a commitment to quality and staying informed.

Continuing Education and Training

Inspectors must keep learning to stay sharp. They join workshops, seminars and online lessons. This helps them learn about new tech, code changes, and trends in property assessment.

“The top house inspectors always seek to grow their skills and keep up with changes. Ongoing learning is very important for giving the best service to our customers.”

Regular Problems in Insurance Claim Arguments

Handling insurance claim arguments often proves difficult for policyholders. Insurance claims adjusters and home appraisal experts often face many challenges. These can make resolving disputes hard.

One big problem is getting low settlement offers from insurance companies. Policyholders often struggle with insurers who try to reduce damage or repair costs. This leads to tough negotiations and the need for solid evidence and expert opinions.

Understanding insurance policy language is another big challenge. Policy documents are full of legal terms and exclusions. This is where insurance claims adjusters and home appraisers play a key role. They help navigate these complexities and fight for the policyholder’s rights.

Showing the full extent of damage is also hard. Insurance companies might underestimate damage. Policyholders must document everything well and get help from professional inspectors to prove their claims.

| Challenge | Description |

|---|---|

| Initial Low Settlement Offers | Insurance companies may try to minimize the extent of the damage or the cost of repairs, leading to frustrating negotiations. |

| Complex Policy Language | Insurance policies can be filled with legal jargon and exclusions, making it difficult for policyholders to understand their coverage and rights. |

| Proving Damage Extent | Insurance companies may attempt to downplay the severity of the damage, requiring policyholders to thoroughly document the situation and enlist professional inspectors. |

To tackle these challenges, policyholders need the help of skilled insurance claims adjusters and home appraisal experts. These professionals offer valuable advice, use their industry knowledge, and use effective strategies. They help ensure policyholders get the fair compensation they deserve.

Building a Strong Case: Documentation and Evidence

When dealing with insurance claim rebuttals, a solid case depends on detailed documentation and strong evidence. To win, you must show a clear, documented record of the property’s state and any defects or structural problems.

Photo and Video Documentation Techniques

Photo and video documentation is key to showing damage or defects. Take high-quality images and videos that clearly show the affected areas. Include close-up shots and wide-angle views. Make sure the evidence is well-organized and labeled for easy use during the claims process.

Written Reports and Professional Assessments

Back up your photos with detailed written reports from professional home inspectors. These reports should give a detailed analysis of the property’s condition. They should highlight any structural evaluation or defect detection issues that matter for the insurance claim. Get full documentation that shows the damage’s extent, causes, and needed repairs or fixes.

Timeline Management for Claims

Keep a detailed timeline of the claims process. Record all interactions with the insurance company, including dates, communication details, and deadlines. This timeline can help show the insurer’s response and support your claim’s validity.

By carefully documenting evidence and managing the timeline, you can build a strong case. This challenges the insurance company’s decision and fights for a fair settlement for repairs or fixes.

Working with Insurance Adjusters and Companies

Working well with insurance adjusters and companies is key for winning property damage claims. As a house inspector, you can link policyholders with insurance providers. You offer insights on risk, damage, and repair costs.

Clear talk is important when working with adjusters. Share detailed evidence like photos and written reports. Know the adjuster’s view and answer their questions well. This teamwork can lead to a fair damage evaluation, helping the policyholder.

Insurance firms have clear rules for claim support. Keep up with the latest standards and rules. Quickly responding to adjuster requests and sending needed documents on time can avoid delays.

Policyholders might need independent or public adjusters for help. These experts can talk to insurance companies for better settlements. Knowing about public adjusters and their fees can help homeowners in the claim process.

By teaming up with adjusters and companies, you can ensure claims are handled right. Your skills and professionalism can greatly impact the claim’s outcome.

“The identification of witness statements, photos or videos of damage, and receipts for repairs are key documents that can be useful during the claims process.”

Advanced Inspection Technologies and Methods

The insurance world is changing fast. House inspectors now use new technologies to give better assessments. These tools help improve inspections and support insurance claims.

Digital Tools for Property Assessment

Inspectors today use digital tools to measure and map properties. They use laser systems, 3D scanning, and drones. These tools help create detailed digital models of homes.

They make the assessment process faster and more accurate. This gives insurers a clear picture of the home’s condition.

Modern Inspection Equipment

Thermal imaging cameras are now a key part of inspections. They find hidden problems like construction deficiencies or moisture. This helps inspectors spot risks and give insurers a better understanding of the property.

Reporting Software Solutions

Inspectors use advanced reporting software to improve their work. This software helps them create detailed, professional reports. Reports include data, visuals, and recommendations.

This makes the reporting process easier. Inspectors can give insurers the underwriting support they need. This helps make fair decisions.

Using new technologies and methods, inspectors play a bigger role in insurance claims. They provide more accurate and detailed assessments. This helps clients win their cases and get fair resolutions.

Legal Aspects of Insurance Claim Rebuttals

Legal problems frequently occur with insurance claim disagreements. Understanding the rules in your state, the details of your insurance contract and your choices if difficulties emerge is very important. Occasionally, attending mediation or visiting court may be necessary to resolve conflicts.

Reports and statements from house inspectors are key in legal battles over insurance claims. Courts stress the need for insurance companies to do thorough checks and act fairly. If they don’t, they could face accusations of “bad faith.”

Understanding property assessment and the insurance claims adjuster process is vital. Getting legal advice can help protect your rights as a property owner. It ensures the insurance company meets its obligations to you.