Here is the 5 Essential Reasons Why Your Business Need Insurance

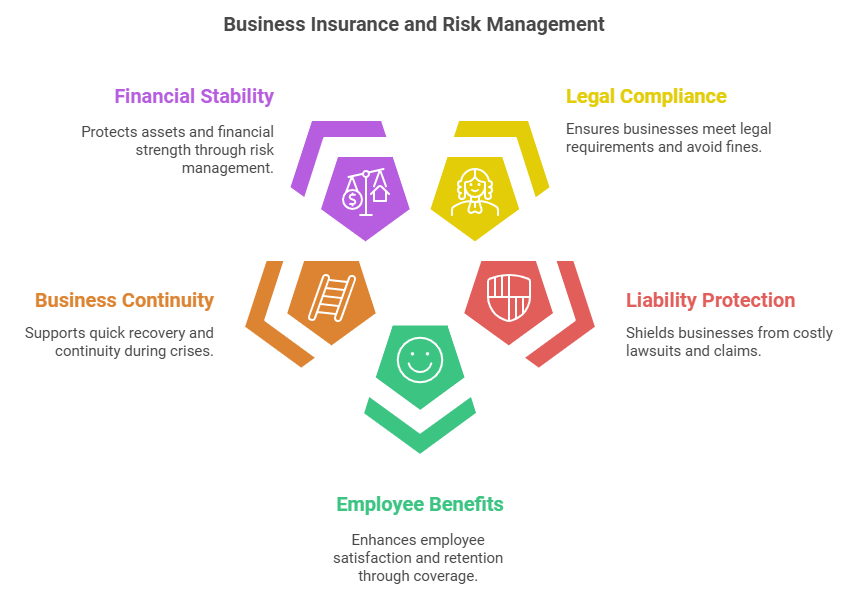

- Legal Requirements and Compliance Standards: Many businesses need certain insurance to avoid fines and run responsibly.

- Securing Your Business Against Liability Claims: Comprehensive liability insurance defends businesses from expensive lawsuits and claims related to accidents or product troubles.

- Employee Protection and Benefits Coverage: Good employee benefits, including health and life insurance, really improve employee happiness and retention.

- Business Continuity and Disaster Recovery Planning: Insurance for business interruptions helps companies quickly restart and continue in times of crisis.

- Financial Stability Through Risk Management: Strong risk management plans, backed by insurance, protect a business’s assets and financial strength against unexpected events.

In today’s world, proper insurance is essential for business success. Size does not matter. Good business insurance gives you the safety and confidence to face business challenges. Let’s look at the top five reasons your business needs insurance. Expert guide insurance provide every type of insurance details.

Understanding the Fundamentals of Business Insurance

Business insurance can seem complex, but knowing the basics is key to protecting your company. It covers liability and financial loss, helping your business stay strong. The right policies are vital for your business’s future.

Types of Coverage Available for Businesses

Businesses have many insurance options to choose from. Each policy tackles different risks and liabilities. Perhaps you require general liability, professional liability, property insurance or workers’ compensation. Initially, determine what your business truly requires.

How Insurance Policies Work Together

Insurance policies have different roles but often work together. For example, general liability covers claims from others, while professional liability protects against service mistakes. Knowing how these policies support each other is key to a strong insurance plan.

Basic Terms and Concepts

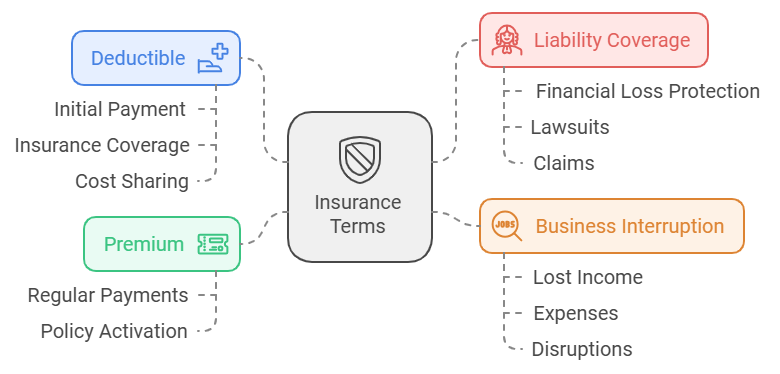

- Deductible: The sum you provide before your insurance begins.

- Premium: The regular payment to keep your policy active.

- Liability coverage: Protects you from financial loss in lawsuits or claims.

- Business interruption: Covers lost income and expenses during disruptions.

Learning these basic terms helps you make smart choices about your insurance. It ensures you have the right protection for your business.

“Proper business insurance coverage is not just a luxury, but a necessity in today’s unpredictable business landscape.”

Safeguarding Your Business Property from Unplanned Situations

Business owners watch over their property closely. This includes your physical property, intellectual property, and financial resources. Insurance is vital for asset protection, disaster preparedness, and risk management.Proper insurance shields your firm from unexpected happenings and keeps operations steady.

Comprehensive business insurance guards your physical assets. This includes your office, equipment, and inventory. It shields them from disasters, fires, or theft. This asset protection can prevent a big loss that could harm your business.

- Protect your physical property with property insurance

- Safeguard your equipment and inventory with commercial property coverage

- Ensure your business can recover from a disaster with business interruption insurance

Your intellectual property, like patents and trademarks, is also important. Specialized insurance can protect these assets from misuse or theft. This keeps your business competitive.

“Comprehensive business insurance is the foundation of effective risk management and disaster preparedness. It provides the peace of mind and financial stability your company needs to weather any storm.”

Insurance also guards your financial assets. It shields against lawsuits and other financial risks. This is important for your company’s long-lasting achievements.

In today’s quickly shifting business environment, reliable insurance is necessary. It helps protect your assets and keeps your business strong. This way, your company can handle unexpected challenges and keep growing.

5 Essential Reasons Why Your Business Need Insurance

Beginning a business journey brings joy and satisfaction. However, it involves dangers, too. Sudden incidents such as hurricanes or equipment failures might injure your financial health. At this point, business insurance enters the scene. It delivers the security your business requires. Important advantages highlight why your business requires insurance to guard yourself and your firm.

Defense Against Natural Calamities

Hurricanes, floods and earthquakes may damage businesses severely. Business insurance helps protect your company from these financial losses. It lets your business get back to normal quickly after a disaster.

Coverage for Theft and Vandalism

Theft and vandalism can be very hard for business owners. They can cause lost assets, damaged property, and disrupt operations. Business insurance covers these issues. It protects your business against financial loss and helps you recover faster.

Safeguarding Against Equipment Breakdown

Equipment failure can stop your business in its tracks. Business insurance often covers equipment breakdowns. This ensures you can fix or replace important machinery and minimize the impact of disaster preparedness.

Getting business insurance is a smart move. It provides your business financial safety and calmness necessary to thrive, regardless of challenges you encounter.

Legal Needs and Compliance Rules

As a business owner, knowing the compliance rules and standards is key. These rules might require certain insurance coverage. Being legally compliant protects you from legal trouble and shows you care about doing things right.

Important areas where legal compliance and insurance coverage meet include:

- Compensation insurance often covers employee injuries and sickness at jobs.

- Liability insurance helps shield businesses from costly lawsuits and claims about injuries, property harm or errors.

- Commercial vehicle insurance is necessary if a job involves using cars or trucks.

- Certain industries, such as healthcare, finance or building, follow specific rules for insurance.

Keeping up with compliance with legal requirements helps your business avoid legal and financial risks. It also shows you’re committed to being responsible and ethical. This might improve your reputation, build trust from others and position your company as a leader in your field.

“Good insurance coverage remains essential, not a luxury, for businesses of all sizes to conduct operations with certainty and follow legal rules.”

Safe Business from Lawsuits

Business owners need to protect companies from lawsuits. This is crucial to keep assets safe and help businesses succeed over time. Insurance for liability is essential for strong risk management. This type of coverage helps guard the business against money loss from injuries or damages to others.

Professional Liability Coverage

Professional liability insurance, called errors and omissions (E&O) coverage, shields your company. It defends against claims of carelessness, errors or not performing duties correctly. Very necessary for businesses providing special services, such as consulting, accounting or legal counsel.

General Liability Protection

General liability insurance protects your business from claims related to bodily harm, property damage and personal/advertising harm. It includes legal protection, settlements and judgments. This liability coverage ensures your business is ready for a variety of risks.

Product Liability Considerations

If your company produces, distributes or offers goods, you require product liability insurance. This coverage shields you from claims involving faulty products, malfunctions or harm. Good risk management with product liability coverage can save your business from huge financial losses.

| Type of Liability Coverage | Key Protections |

|---|---|

| Professional Liability | Covers claims of negligence, mistakes, or failure to perform professional services as expected |

| General Liability | Protects against claims of bodily injury, property damage, and personal/advertising injury caused by your operations, products, or services |

| Product Liability | Safeguards against claims related to product defects, malfunctions, or injuries caused by the use of your products |

Knowing about the different liability coverage types and having a solid risk management plan is key. It helps protect your business against financial loss. You retain the confidence of your clients, partners and stakeholders.

Protection and Benefits for Employees

As a business owner, keeping workers secure and content is crucial. Picking suitable insurance demonstrates concern for them. It also meets legal rules. Let’s see how insurance helps your business and attracts great workers.

Protecting Staff with Workers’ Compensation

Many states ask for workers’ compensation insurance. It supports staff injured while working. It covers doctor bills and lost income, helping them recover and return to their tasks.

Providing Health Benefits

Health insurance is a big plus for your employee benefits package. It includes health, dental, eye care and other benefits. It shows you care about your team’s health and follow legal compliance and business insurance rules.

Investing in Life and Disability Insurance

Life and disability insurance support when an employee passes away or becomes very ill. These employee benefits protect your team and show you value their well-being. They also attract new employees.

| Insurance Coverage | Key Benefits | Legal Compliance |

|---|---|---|

| Compensation for Workers | Pays for medical costs and lost income from job-related injuries. | Mandatory in most states |

| Health Protection | Includes care for medical, dental, vision and prescribed medication. | Not federally mandated, but can enhance employee benefits |

| Life and Disability Insurance | Offers financial protection for employees and their families | Not legally required, but can improve business insurance and employee benefits |

By getting good employee benefits coverage, you meet legal needs and show you care. This helps you keep and attract the best workers. It makes your business insurance stronger and helps your company grow.

Business Continuity and Disaster Recovery Planning

Keeping businesses operating effortlessly is important. You need a solid plan for disaster recovery and risk management. A good insurance plan protects your assets and helps your business recover quickly.

Emergency Response Strategies

A good emergency plan can save your business from disaster. Your insurance should cover the costs and help you respond fast. This includes:

- Immediate access to emergency funds to address critical needs

- Assistance with securing temporary facilities or equipment

- Support for communicating with employees, customers, and stakeholders

- Guidance on navigating legal and regulatory requirements

Recovery Time Objectives

Setting clear recovery time objectives (RTOs) is vital. They tell you how long you can be down without losing too much. Your insurance should match your RTOs, so you can get back to work quickly.

| Recovery Time Objective (RTO) | Potential Impact | Recommended Insurance Coverage |

|---|---|---|

| Less than 4 hours | Immediate threat to customer service, revenue, and reputation | Business interruption, extra expense, and disaster recovery insurance |

| 4-24 hours | Significant disruption to operations and financial performance | Business interruption, extra expense, and disaster recovery insurance |

| 1-7 days | Moderate impact on operations and financial performance | Business interruption and extra expense insurance |

Aligning your insurance with your disaster recovery aims readies your business for every challenge. In this manner, your business remains operational, even during difficult times.

Financial Stability Via Risk Management

Nowadays, the business world changes quickly, maintaining financial stability is crucial. Insurance greatly supports risk management and protects your company’s finances. With good insurance, you can guard against many possible losses. This lets you focus on growing and innovating.

At the core of keeping finances stable is managing risks well. Insurance policies are like a safety net for your business. They protect you from things like natural disasters and equipment failures. This way, you can handle any challenge and come out stronger.

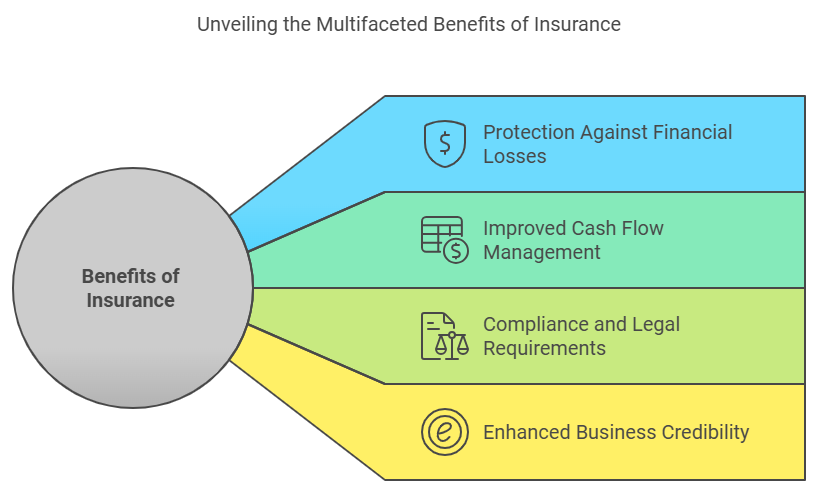

The Benefits of Insurance for Financial Stability

- Protection Against Financial Losses: Insurance keeps your business safe from sudden, big problems. It helps you bounce back without losing money.

- Improved Cash Flow Management: By letting insurance handle risks, you can manage your money better. This means you can use your resources more wisely.

- Compliance and Legal Requirements: The right insurance meets legal rules and avoids expensive lawsuits.

- Enhanced Business Credibility: Showing you care about risk management through insurance makes your company more trustworthy.

Remember, your business’s financial health is the base of everything. With insurance, you can open up new chances, face any challenge, and grow sustainably over time.

| Insurance Coverage Type | Contribution to Financial Stability |

|---|---|

| Property Insurance | Guards your business property from physical harm, letting your activities proceed without pause. |

| Liability Insurance | Defends your company from expensive legal claims and agreements, protecting your financial reserves. |

| Business Interruption Insurance | Offers money support to sustain your operations and cash flow during a covered break. |

By accepting insurance’s power, individuals unlock new opportunities, overcome challenges and create pathways for lasting growth.

“Insurance works not only as a protective shield but also as a clever method for establishing financial strength and driving business expansion.”

Building Business Credibility with Insurance Protection

For a business owner, reputation matters a lot for success. Obtaining business insurance demonstrates responsibility towards legal duties and risk management. This increases trust among clients, partners and investors.

Creating Trust with Stakeholders

Having the right business insurance shows you value your stakeholders’ worries. It makes customers trust you more. Partners and investors see your business as stable and reliable.

Meeting Industry Standards

Your industry might need specific business insurance to follow legal compliance rules. Having the right policies shows you follow industry standards. This makes your business stand out as responsible and focused on asset protection.

| Insurance Coverage | Benefit |

|---|---|

| General Liability Insurance | Shields from other people’s demands for injury or damage to belongings. |

| Professional Liability Insurance | Covers errors or omissions in your professional services |

| Property Insurance | Safeguards your business assets from physical damage or loss |

Investing in business insurance lifts your credibility and trust with stakeholders. It shows you care about following laws and protecting what you own. This maybe opens new doors and strengthens your position in the market.

Conclusion

Business insurance is very important for protecting your company’s future. It helps you know coverage, protect assets and handle risks. This keeps your business’s money stable and successful.

Insurance guards your business against disasters, theft and claims. The right policies give you peace of mind. A good plan for handling risks lifts your credibility and trust with stakeholders.

Investing in business insurance is wise and necessary for your company’s growth. Look at what you need, explore choices and decide carefully. This way, you protect your assets, lower risks and set your business up for success.