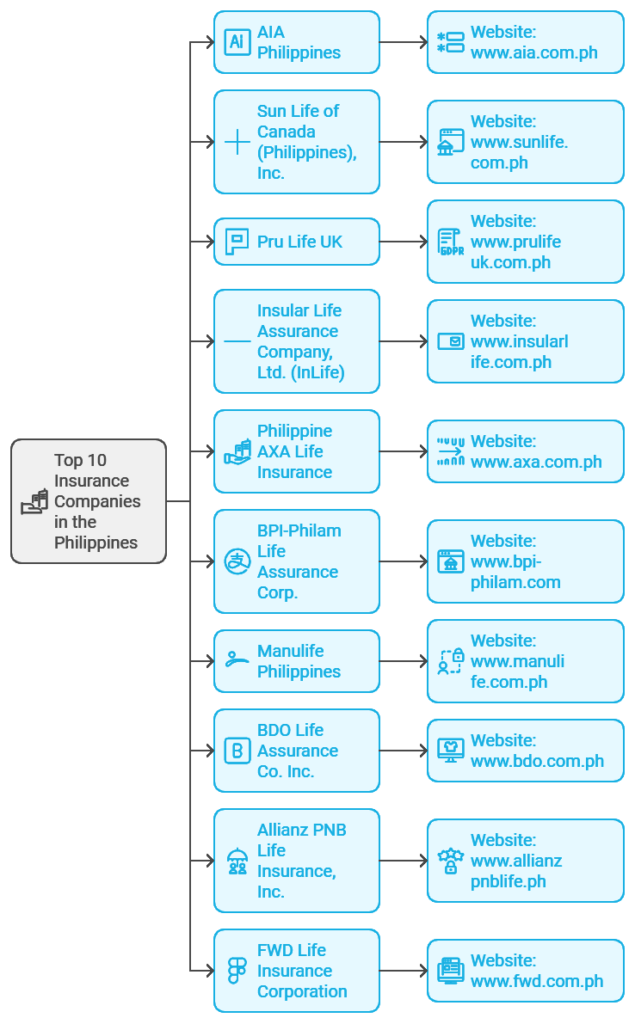

Top 10 Insurance Companies In the Philippines

Latest Top 10 Insurance Companies In the Philippines 2024 based on their net worth, premium income, and market performance as detailed in the sources:

- Sun Life of Canada (Philippines), Inc. The company is mostly commended for its rich insurance portfolio and sound financial position; in fact, it is highly ranked as the leading company in terms of premium income.

- AIA Philippines – Known for having enormous wealth and various kinds of products, which ranges from investment-linked, health, and life insurance.

- Pru Life UK – The wide range of products they have as well as high premium income makes them stand out.

- Insular Life Assurance Company, Ltd. (InLife) -The biggest life insurance company owned by Filipinos, renowned for its customized products and substantial net worth.

- Philippine AXA Life Insurance – Renowned for providing excellent customer service, coming up with creative ideas, and having a significant market presence.

- BPI-Philam Life Assurance Corp. -It benefits from its strategic alliance with Bank of the Philippine Islands, an accessible insurer for insurance products.

- Manulife Philippines – A reputed company with an established background with the best variety of financial solutions and with a satisfied customer base.

- BDO Life Assurance Co. Inc. – It is a BDO Unibank affiliate. And with extensive outreach, provides an array of diversified insurance products.

- Allianz PNB Life Insurance, Inc. – Known for its reputable global backing and robust investment options

- FWD Life Insurance Corporation – Modern and customer-friendly, fast-moving in the market.

These companies stand out for their financial strength, wide range of products, and dedication to customer happiness.

Top 10 Insurance Companies in the Philippines 2024 Full Information

Leading firms providing life insurance in the Philippines remain stable and present a wide range of products. They offer solutions for protection, wealth management, and long-term planning. These companies meet the diverse needs of Filipino families and individuals.

Sun Life of Canada Philippines Inc.

Sun Life of Canada (Philippines), Inc. ranks as a prominent insurance firm in the Philippines. It is known for strong premium income and many different products. As a part of Sun Life Financial group worldwide, it provides many insurance choices. These include life, health, accident and investment-linked products. They are created to cover the needs of people, families and companies.

The company prioritizes excellent customer service. It offers personal advice through a network of skilled financial advisors and easy-to-reach support. Digital tools, such as an online portal and mobile app, help with managing policies, processing claims and accessing services, which really improve the customer experience.

Sun Life’s product portfolio is notable for its breadth and inclusiveness, featuring unique offerings like investment-linked insurance plans that blend life coverage with investment growth opportunities, educational plans for future academic funding, and retirement plans aimed at securing financial comfort in later years. These offerings are crafted to help clients achieve lifelong financial security and healthier living.

Key Features of Sun Life of Canada (Philippines), Inc.:

| Feature | Details |

|---|---|

| Product Range | Life insurance, health insurance, accident insurance, investment products |

| Customer Service | Robust support through advisors and digital tools |

| Special Offerings | Investment-linked products, educational plans, retirement plans |

| Digital Accessibility | Online portal and mobile app for easy management |

| Financial Stability | High premium income indicating strong market presence |

This comprehensive approach positions Sun Life not just as an insurance provider but as a vital partner in financial planning and security.

AIA Philippines

AIA Philippines, an important company in the insurance business of the Philippines, holds a very solid financial status with a large net worth, showing its capacity to fulfill customer commitments. It provides a wide selection of insurance products, like life, health, accident and investment-linked plans. These products serve various needs, such as personal and family safety or business protection, highlighting the company’s promise to offer security and financial growth chances to its clients.

The organization focuses on customers, offering tailored service with many agents and advanced online tools. AIA Philippines simplifies the way people buy and handle insurance with easy-to-use online systems. Their promise includes help after sales, so clients get prompt and useful support.

AIA Philippines stands out with new ideas like wellness programs that give rewards for healthy habits and special plans for serious illness and retirement. These efforts focus on giving financial security and encourage a healthier way of life for clients. This matches the company’s goal to help people enjoy healthier, longer and better lives.

Key Features of AIA Philippines:

| Feature | Details |

|---|---|

| Product Diversity | Life, health, critical illness, and investment-linked insurance |

| Customer Focus | Personalized service via agents and digital platforms |

| Innovative Programs | Wellness incentives and specialized plans for critical care and retirement |

| Digital Solutions | User-friendly online access for policy management and claims |

| Financial Strength | High net worth indicating robust financial health |

Pru Life UK

Pru Life UK belongs to the big financial group Prudential PLC. People in the Philippines know it for its strong income from premiums. This shows its stable finances and trust in the market. The company provides many kinds of insurance. It includes life insurance, health coverage, accident protection and plans linked to investments. These meet different financial needs and goals of customers.

Pru Life UK promises a better customer experience with new digital tools. This probably helps customers handle insurance easily. The company also receives praise for teaching Filipinos about managing finances. These lessons support people in choosing the right insurance and investments.

The insurer’s portfolio presents special options like savings-linked insurance plans. These plans connect life insurance benefits with chances for money growth, giving policyholders financial safety and possibilities for growth.

Key Features of Pru Life UK:

| Feature | Details |

|---|---|

| Product Variety | Life insurance, health insurance, accident insurance, investment-linked plans |

| Premium Income | Strong financial intake indicating trust and stability |

| Digital Innovation | Advanced digital platforms for easy access and management of policies |

| Customer Education | Initiatives aimed at improving financial literacy |

| Specialized Products | Savings-linked plans for combined insurance and investment benefits |

Philippine AXA Life Insurance

Philippine AXA Life Insurance belongs to the worldwide AXA Group. It enjoys a strong reputation in the Philippine insurance market due to its creative solutions and outstanding customer service. The company provides many insurance options like life, health and investment-linked plans. These plans address the specific needs of people, families and businesses.

AXA Philippines works to simplify insurance through easy digital tools. Customers use these tools online to manage policies, submit claims and reach services. The company shows its focus on new ideas through unique products designed for particular customer requirements, like special health plans and retirement options.

AXA cares about customers by focusing on personal advice and help. Many skilled agents and customer service groups work together to give clients the guidance they probably need for a safe financial future.

Key Features of Philippine AXA Life Insurance:

| Feature | Details |

|---|---|

| Product Range | Comprehensive offerings in life, health, and investment-linked insurance |

| Customer Service | High focus on client support and personalized service |

| Innovation | Use of advanced technology for product development and customer interaction |

| Digital Accessibility | Robust online platforms for policy management and customer engagement |

| Custom Solutions | Tailored insurance products to meet specific customer requirements |

Insular Life Assurance Company, Ltd. (InLife)

Insular Life Assurance Company, Ltd. (InLife), the oldest life insurance company owned by Filipinos, has a large net worth. This shows its strong financial stability and trustworthiness. InLife provides many insurance options. These include life, health and plans connected to investments. They meet the different needs of Filipino people.

Focused on empowering Filipinos, InLife includes innovative elements in its offerings. These involve adaptable insurance plans mixed with investment chances, designed to improve the financial stability and growth of its customers. The firm takes pride in its strong connection to Filipino values, shown in their community projects and local support efforts.

InLife is known for its dedication to delivering outstanding customer help with a complete online system for simple handling of policies and smooth customer communication. This method provides clients with an effortless and user-friendly experience, strengthening their role as a leader in the local insurance field.

Key Features of Insular Life Assurance Company, Ltd. (InLife):

| Feature | Details |

|---|---|

| Product Diversity | Life, health, investment-linked insurance |

| Financial Stability | Significant net worth demonstrating financial robustness |

| Local Empowerment | Focus on community-driven initiatives and Filipino values |

| Innovation | Flexible and innovative insurance solutions |

| Digital Services | Advanced digital platform for policy management |

BPI-Philam Life Assurance Corp.

BPI-Philam Life Assurance Corp. results from a partnership between the Bank of the Philippine Islands (BPI) and Philam Life, a leading insurance company in the region. It uses BPI’s extensive network of banks and Philam Life’s expertise in insurance. It provides a variety of insurance products to numerous customers across the Philippines.

The company provides different insurance products combined with banking services. This combination allows clients to handle their financial and insurance needs at the same time. Customers probably find the accessibility and convenience improved, supporting a simpler way to plan finances.

BPI-Philam pledges to give superior customer service and employs the latest technology to offer immediate support and services. These are available through BPI’s broad branch network and online banking options. Their products include life insurance, health coverage and investment-linked plans, all crafted for client security and financial development.

Key Features of BPI-Philam Life Assurance Corp.:

| Feature | Details |

|---|---|

| Strategic Alliance | Collaboration between BPI and Philam Life |

| Product Accessibility | Wide range of products easily accessible through banking channels |

| Customer Convenience | Integrated banking and insurance services |

| Technological Integration | Utilizes BPI’s banking technology for enhanced customer experience |

| Comprehensive Offerings | Includes life, health, and investment-linked insurance plans |

Manulife Philippines

Manulife Philippines belongs to the worldwide Manulife Financial Corporation, famous for strong financial health and different insurance choices. The firm offers diversified products in insurance, particularly the life, health retirement plan, and investment-linkage policies, ensuring an array of choices among diverse needs of its target clientele. Manulife Philippines is known for efforts to give flexible as well as personalized insurance that would specifically cater to one’s needs, whether the requirements are for people, family, or business setups.

Manulife focuses on digital change to improve customer experiences. This helps people access services easier and arrange their policies better through online platforms. Also, the company gives importance to financial education, offering resources and tools to support clients in deciding wisely about their financial futures.

Manulife’s large group of agents and alliances provides widespread coverage and access all over the Philippines. It is a trusted brand in the insurance field.

Key Features of Manulife Philippines:

| Feature | Details |

|---|---|

| Financial Strength | Part of a global financial institution with strong stability |

| Product Range | Extensive options including life, health, and investment-linked policies |

| Digital Innovation | Advanced platforms for customer interaction and policy management |

| Educational Commitment | Focus on financial literacy and client education |

| Market Coverage | Wide accessibility through a robust network of agents |

BDO Life Assurance Co. Inc.

BDO Life Assurance Co. Inc. is supported by BDO Unibank, the biggest bank in the Philippines. It has many insurance products, from life insurance to those linked with investments. Working with BDO Unibank, BDO Life connects with many people throughout the country.

The company uses the many BDO branches to offer insurance products to more of the bank’s customers, bringing more ease and linking banking with insurance services. This teamwork between banking and insurance makes managing finances simpler for clients, giving a smooth experience.

BDO Life promises exceptional service, backed by BDO Unibank’s fame for trust and attention to customers. Their products help meet changing needs of Filipinos today. They mix financial safety with chances for growth.

Key Features of BDO Life Assurance Co. Inc.:

| Feature | Details |

|---|---|

| Supporting Bank | Backed by BDO Unibank, the largest bank in the Philippines |

| Product Diversity | Offers life and investment-linked insurance products |

| Market Reach | Utilizes BDO’s extensive network for broad market access |

| Integrated Services | Seamlessly combines banking and insurance services |

| Customer Focus | Committed to high-quality customer service and accessibility |

Allianz PNB Life Insurance, Inc.

Allianz PNB Life Insurance, Inc. belongs to both Allianz Group and Philippine National Bank (PNB). It brings together strong global insurance knowledge and local banking connections. This partnership allows Allianz PNB to provide many new and customized insurance options, such as life, health and investment-linked products.

The company is well-known for offering important investment choices. Clients receive chances to join global markets with their insurance plans. This option lets customers vary their investment collections and have the safety of insurance protection.

Allianz PNB Life highlights client assistance and provides extra services through PNB’s large branch network. This approach improves the ease and reach of their insurance products throughout the Philippines.

Key Features of Allianz PNB Life Insurance, Inc.:

| Feature | Details |

|---|---|

| Global Partnership | Joint venture between Allianz Group and PNB |

| Investment Opportunities | Offers significant global investment options within insurance products |

| Product Range | Broad range of tailored insurance solutions |

| Market Accessibility | Leverages PNB’s network for widespread customer access |

| Innovative Solutions | Focus on innovative and customized insurance offerings |

FWD Life Insurance Corporation

FWD Life Insurance Corporation began in the Philippines in 2014. People know it for a fresh view on insurance. The focus is on simplicity and new ideas. The company grew quickly in the market. It used digital tools to improve customer support and simplify insurance steps.

FWD Life provides different life and health insurance choices. These choices are easy to understand and reach many people, especially young individuals. This happens because of their digital focus. The company’s products have simple rules and new coverage ideas. These ideas help with both regular and new customer demands.

FWD Life shines for its forward-thinking method with customers, using technology to build interactive and simple platforms. These platforms let customers handle their policies with ease and efficiency.

Key Features of FWD Life Insurance Corporation:

| Feature | Details |

|---|---|

| Modern Approach | Emphasizes simplicity and digital innovation in insurance |

| Rapid Growth | Quick market penetration and growth since its establishment |

| Product Accessibility | Focus on creating understandable and accessible insurance products |

| Digital Engagement | Advanced use of technology for customer interaction |

| Innovative Coverage | Offers innovative insurance solutions for diverse needs |

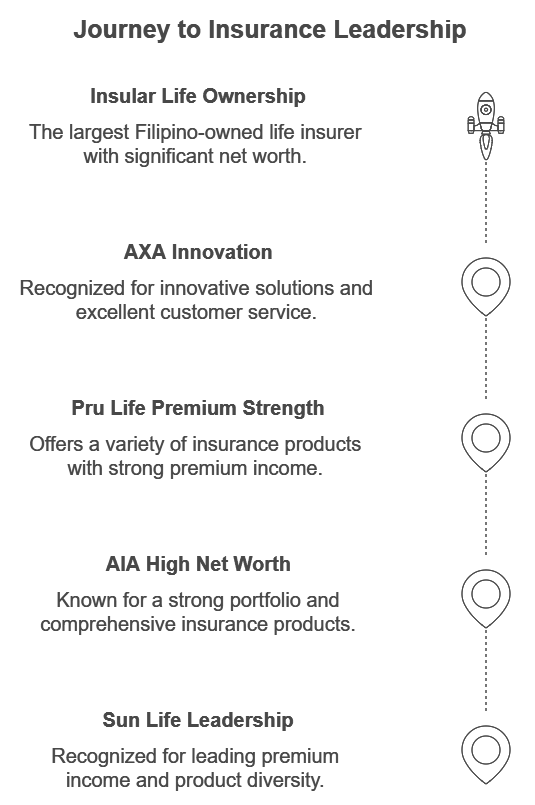

Table and Picture highlighting the ranks and notable achievements of the top 10 insurance companies in the Philippines:

| Company Name | Ranking | Highlights |

|---|---|---|

| Sun Life of Canada Philippines Inc. | 1st in Premium Income | Leads in premium income, offering a diverse range of products. |

| AIA Philippines | High Net Worth | Known for its strong portfolio and comprehensive insurance products. |

| Pru Life UK | Strong in Premium Income | Offers a variety of insurance products, strong in premium income. |

| Philippine AXA Life Insurance | Known for Innovation | Recognized for innovative solutions and excellent customer service. |

| Insular Life Assurance Company, Ltd. (InLife) | Largest Filipino-owned | The largest Filipino-owned life insurer with significant net worth. |

| BPI-Philam Life Assurance Corp. | Strategic Alliance with BPI | Notable for its partnership with BPI, offering accessible products. |

| Manulife Philippines | Renowned for Financial Strength | Known for its financial strength and extensive range of solutions. |

| BDO Life Assurance Co. Inc. | Supported by BDO Unibank | Offers a diverse product set with substantial market reach. |

| Allianz PNB Life Insurance, Inc. | Strong Global Backing | Noted for its significant investment options and global backing. |

| FWD Life Insurance Corporation | Noted for Rapid Growth | Modern approach with a focus on rapid growth in the market. |

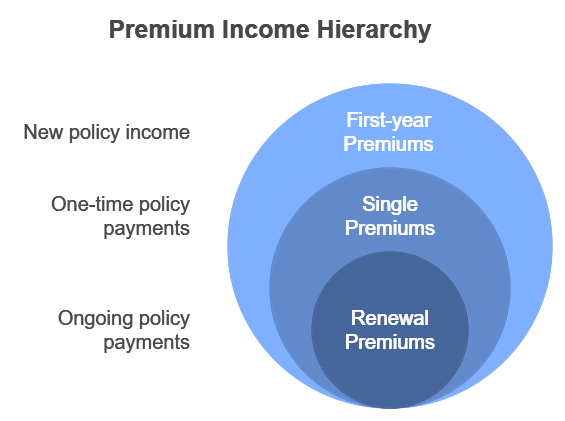

Premium Income and Performance Metrics

Premium income and performance statistics of life insurance companies in the Philippines are important. They indicate how financially secure and expanding these firms are. An important statistic is the New Business Annual Premium Equivalent (NBAPE), showing the yearly premium of fresh policies. The premium income breakdown offers a detailed view of a company’s income from various types of premiums. Observing these life insurance performance statistics reveals how strong and competitive the leading insurance companies in the Philippines probably are.

New Business Annual Premium Equivalent (NBAPE)

NBAPE is a key indicator of a company’s success in selling new policies. It shows how well a company can attract and keep new customers. A high NBAPE means a company is doing well in sales and marketing, and is appealing to many.

Premium Income Breakdown

The premium income breakdown gives more details about a company’s financial health. It breaks down the income into three main parts:

- First-year premiums – Premiums from new policies

- Single premiums – One-time payments

- Renewal premiums – Payments from ongoing policies

Looking at these parts can tell us how well a company keeps customers, how steady its income is, and where it might need to improve or grow.

“Understanding the premium income and performance metrics is key to judging the financial strength and competitiveness of life insurance providers in the Philippines.”

Customer Satisfaction and Reputation

When picking a life insurance company in the Philippines, it’s key to look at their reputation and how happy their customers are. Checking how well they handle claims and their customer service can tell you a lot. It shows if they can really meet your needs and expectations.

A good reputation means a company is reliable, quick to respond, and honest. This gives you confidence when you choose a life insurance provider for your family’s future. The customer satisfaction life insurance companies get and the reputation life insurance providers have shows their dedication to great claims processing and customer service. Expert guide insurance provide proper customer satisfaction with proper detail.

| Key Factors | Top Performing Life Insurance Companies |

|---|---|

| Claims Processing | Sun Life of Canada Philippines Inc., Pru Life UK, Allianz PNB Life |

| Customer Service | Pru Life UK, Insular Life, Philippine AXA Life Insurance |

| Overall Customer Satisfaction | Insular Life, Pru Life UK, Sun Life of Canada Philippines Inc. |

Looking into a life insurance company’s reputation and how happy their customers are can help a lot. It tells you if they can keep their promises and protect your family’s money. This info helps you pick the best life insurance company in the Philippines.

“Selecting a life insurance company with a solid name and high customer satisfaction probably brings comfort. Your family’s money future probably stays safe.”

Emerging Trends in the Philippine Insurance Industry

The Philippine insurance industry is changing fast. New trends are shaping its future. Insurers are now focusing on digital transformation, personalized products, and sustainability.

Digital technologies grow crucial in the industry. Insurers utilize data analytics and AI to better customer service. They also use digital platforms to make operations smoother and offer new solutions.

This digital shift helps insurers reach more people. It also makes them more efficient. They can now meet the changing needs of their customers better.

Insurers are also creating personalized products now. They use customer data to make insurance plans that fit each person’s needs. This method leaves customers more satisfied and supports insurers in expanding their market share.

The industry now pays more attention to sustainability and social responsibility. Insurers develop products beneficial for the planet and society. This demonstrates their dedication to supporting people and communities over time.

With these trends increasing, the insurance sector in the Philippines expects further growth and innovation. Accepting digital, personal and sustainable trends lets insurers address the needs of the Filipino market. They also contribute to the country’s economic and social development. Check more insurance companies which is top 5 of Australia steadfast marine.

Conclusion

To sum up, getting a life insurance policy from top companies in the Philippines really improves your family’s financial safety. Companies such as Sun Life, AIA Philippines, Pru Life UK, Philippine AXA, Insular Life, BPI-Philam, Manulife, BDO Life, Allianz PNB and FWD Life are well-known for strong finances, full product options and high customer happiness.

These features mean they are trusted and solid choices for anyone seeking to guard their family’s future. Picking the right insurer is key and these firms stand out in the field, making your investment in life insurance wise and helpful.

1 thought on “Latest Top 10 Insurance Companies In the Philippines 2024”