Here is the Latest Top 5 Health Insurance Companies In Australia Steadfast Marine.

- Medibank: Offers extensive coverage with a focus on preventive health, catering to individuals and families.

- Bupa: Famous for adaptable, complete health plans and a worldwide network of providers.

- HCF: Australia’s biggest not-for-profit health insurer, famous for low-cost, clear coverage.

- NIB: Offers straightforward access to medical services with good value health policies..

- HBF: Focuses on member benefits and strong customer service, primarily serving Western Australia.

These leaders in private health insurance offer tailored plans to meet diverse healthcare needs.

In Australia, the top 5 health insurance companies lead the way. They offer wide coverage and tailored plans for everyone. Medibank, Bupa, HCF, NIB, and HBF are at the forefront. They alter the look of private health insurance in the nation.

This article will help you choose the right health insurance. It will highlight what each company offers best. This way, you can make a smart choice for your health care. More you can check every type of insurance ideas on Expert Guide Insurance.

Understanding Australia’s Healthcare System

Australia’s healthcare system is a mix of public and private parts. It offers full coverage for its people. Medicare, the government-funded public insurance, is at the heart of this system. It gives free or low-cost treatment by doctors and free hospital care.

Medicare: A Foundation of Public Healthcare

Medicare is key to Australia’s healthcare. It makes sure all Australians get the medical care they need. This public insurance protects various healthcare services, including doctor appointments, hospital stays and examinations.

However, Medicare does not include all costs. So, many Australians buy private health insurance to get more benefits. This way, they can get dental, optical, and physiotherapy services, and choose their own doctor and hospital.

The Role of Private Health Insurance

Private health insurance is a big part of Australia’s healthcare. It offers benefits not covered by Medicare. This lets Australians get the medical care they want, not just what Medicare covers.

This mix of Medicare and private insurance makes Australia’s healthcare system strong. It meets the different needs of Australians. This way, everyone can get quality medical care, with the freedom to choose their own coverage.

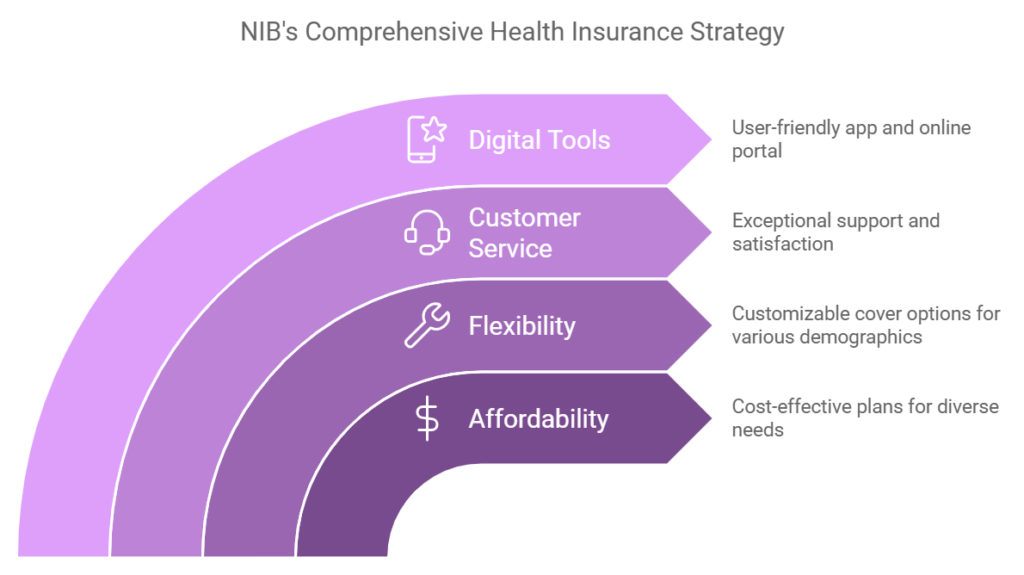

NIB: Affordable and Accessible Health Coverage

In Australia, NIB is known for affordable and accessible health insurance. They are some of the best insurances out there; their health plans are quite direct and cost-effective. Suitable for any person who would consider an individual plan and then group, couple, family, and also to those over sixty-five.

NIB is special because it offers flexible cover options. Customers can pick basic hospital cover, extras cover, or both. This makes NIB a favorite among young Australians looking for affordable health insurance.

NIB also shines in customer service and digital tools. Its app and online portal make it easy for customers to manage their health plans. This improves the overall experience for everyone.

NIB is all about giving customers value and flexible plans. It offers personalized solutions and uses digital tools to stay ahead. This makes NIB a top player in Australia’s health insurance market.

“NIB’s focus on affordability and accessibility has made them a trusted choice for Australians seeking affordable and flexible health coverage.”

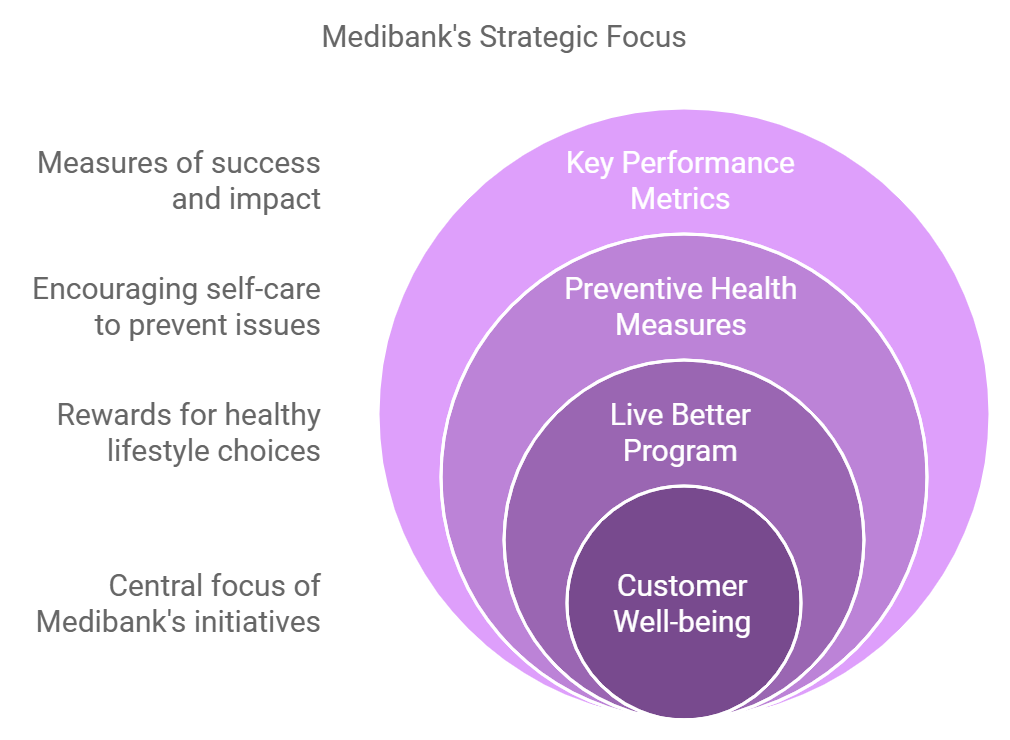

Medibank: A Household Name in Health Insurance

Medibank is a famous health insurance company in Australia. It offers wide medical coverage and works with many healthcare professionals. Medibank is known for quality care and new solutions, making it a top choice in the field.

Comprehensive Coverage and Extensive Network

Medibank has health insurance plans for everyone, from singles to families. It covers hospital stays, extra services, and surgeries. With a big network of doctors and specialists, customers get many healthcare options.

Medibank’s family plans are special, with lots of benefits for maternity, kids’ health, and family extras. This approach helps families get the care they need, from check-ups to special treatments.

Loyalty Programs and Preventative Health Initiatives

Medibank also cares about its customers’ well-being. Its Live Better program rewards healthy choices and lifestyle habits. This shows Medibank’s commitment to helping customers stay healthy.

Medibank focuses on preventing health problems and encourages customers to take care of themselves. This approach helps the healthcare system and ensures policyholders get the care they need.

| Key Metrics | Value |

|---|---|

| Market Share | 27.3% |

| Customer Interactions with Live Better | Approximately 760,000 |

| Net Resident Policyholder Growth | 82,500 (4.6% increase) |

| Total COVID-19 Financial Support | Around $300 million |

| Total Customers | 3.7 million |

| Customer Advocacy (Average Service NPS) | 37.1 (+5.3) |

| Group Net Profit After Tax | $441.2 million (+39.8%) |

| Health Insurance Segment Revenue | $6,680.3 million |

| Employee Engagement | 83% |

Medibank is dedicated to its customers and offers great coverage and new ideas. It’s a trusted name in Australian health insurance. Medibank keeps setting high standards in healthcare and customer support.

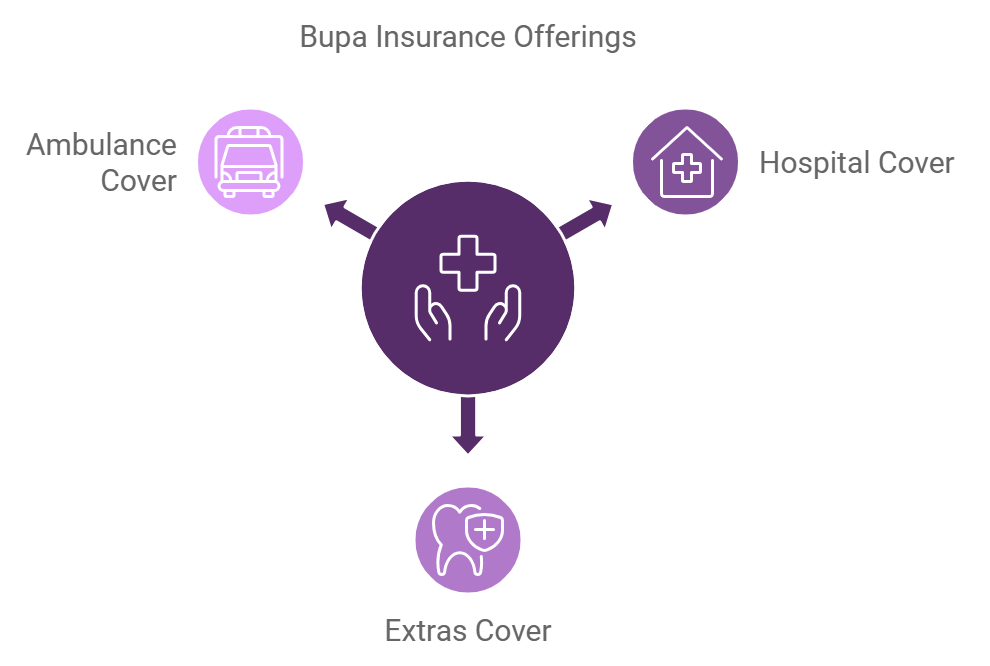

Bupa: Global Expertise, Local Care

Bupa is a top global healthcare provider. It brings its wide range of insurance products to Australia. Bupa focuses on holistic health and wellness, aiming to meet the needs of individuals and families.

Extensive Range of Health Insurance Products

Bupa offers a wide range of health insurance in Australia. It has everything from basic hospital and extras cover to plans for the elderly and families. Bupa’s plans are designed to fit different needs, thanks to its global experience.

Holistic Approach to Health and Well-being

Bupa does more than just health insurance. It supports a holistic approach to health and wellness. Bupa provides preventive healthcare programs, coaching, and counseling to help customers stay well.

With its global knowledge, diverse insurance, and focus on wellness, Bupa is a trusted partner in Australia. It offers coverage that is both wide-ranging and personalized.

| Product | Description | Key Benefits |

|---|---|---|

| Bupa Hospital Cover | Hospital insurance that provides coverage for many treatments and procedures. | Access to private hospital accommodation Cover for medical procedures and surgeries No excess for children |

| Bupa Extras Cover | Offers advantages for many healthcare services, such as dental, eye care and physical therapy. | Large yearly limits for dental, visual and other treatments. No waiting times for various services. Access to Bupa’s list of approved service providers. |

| Bupa Ambulance Cover | Pays for the price of urgent ambulance rides. | Available all over the country for urgent ambulance needs. No extra fees for using ambulances. Low monthly payments. |

“Our commitment to the health and wellbeing of our customers drives everything we do at Bupa. We aim at offering insurance, support, and resources that help them live healthier and happier lives.”

–Sarah Johnson, Bupa Australia Regional Director

HCF: A Not-for-Profit with a Difference

HCF operates as Australia’s largest health insurer without aiming for profit. It functions differently because it prioritizes members over shareholders. Instead of seeking wealth, it allocates its earnings to better benefits and services for its members.

Flexible and Tailored Health Insurance Policies

HCF offers health insurance plans that are flexible and tailored. This means customers can choose what fits their needs and budget. It’s known for its extras cover, which includes dental, optical, and alternative therapies.

HCF also focuses on keeping you healthy with its My Health Guardian program. This program helps members stay well by providing support and resources. It’s all about taking care of your health.

“HCF’s commitment to providing quality, comprehensive health cover has earned it multiple state awards and a national award for exceptional value in hospital, extras, and package cover.”

HCF is known for its flexible plans, tailored options, and focus on members. It’s a not-for-profit that truly cares about its members’ health.

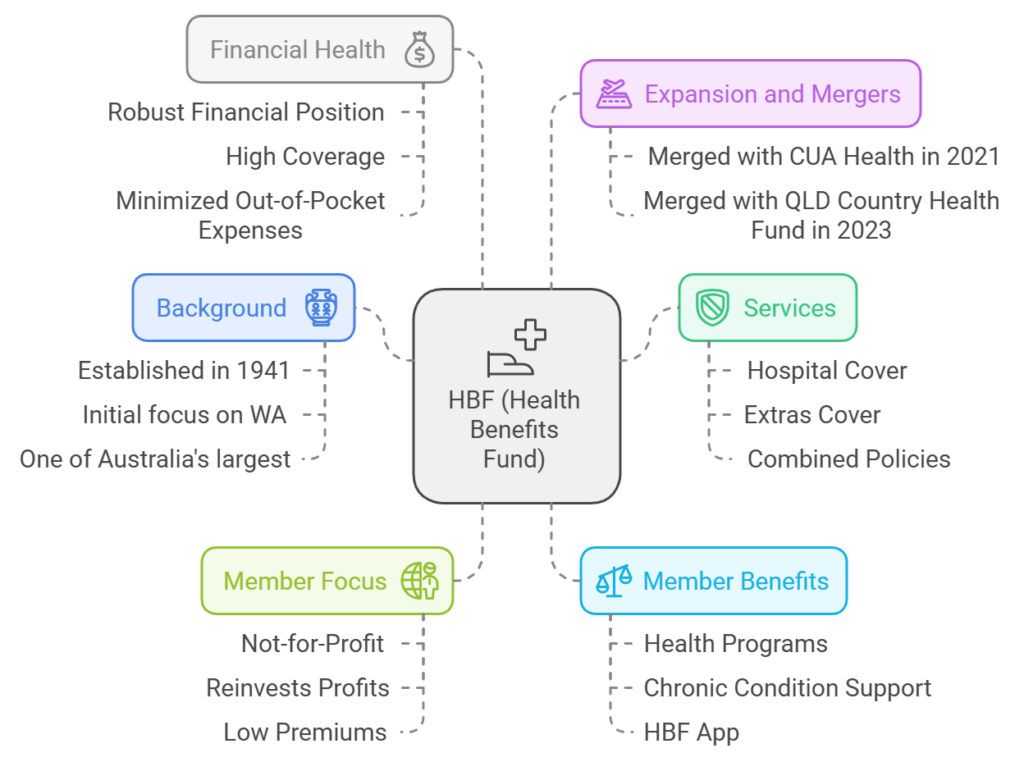

HBF (Health Benefits Fund)

For a more holistic view of HBF (Health Benefits Fund), here is a summarized overview based on the detailed information from the sources:

- Background: HBF began in 1941, first providing health support in Western Australia. It started before the government offered health cover to everyone. Now, it ranks among Australia’s biggest health insurance companies.

- Services: HBF gives many health insurance choices, such as hospital cover, extras cover and combined plans. Hospital cover goes from simple to thorough, covering hospital treatments and surgeries. Extras cover provides for services like dental care, eye care and therapy.

- Member Focus: As a not-for-profit, HBF uses all profits to enhance its services and keep premiums low for its members. This way, members’ needs always come first.

- Expansion and Mergers: Over the years, HBF joined with other health funds, including CUA Health in 2021 and Queensland Country Health Fund in 2023, growing its reach throughout Australia.

- Member Benefits: HBF gives many member advantages, like health programs for chronic problems, joint pain and overall wellness. Members may also use the HBF app to handle their insurance conveniently.

- Financial Health: As of the latest reports, HBF has continued to maintain a robust financial position with significant coverage across its services. They report high percentages of hospital-related charges covered, minimizing out-of-pocket expenses for members.

For direct access to more detailed information and specific policy details, you can visit HBF’s official website. If you need details on a particular aspect of their services or company operations, feel free to ask!

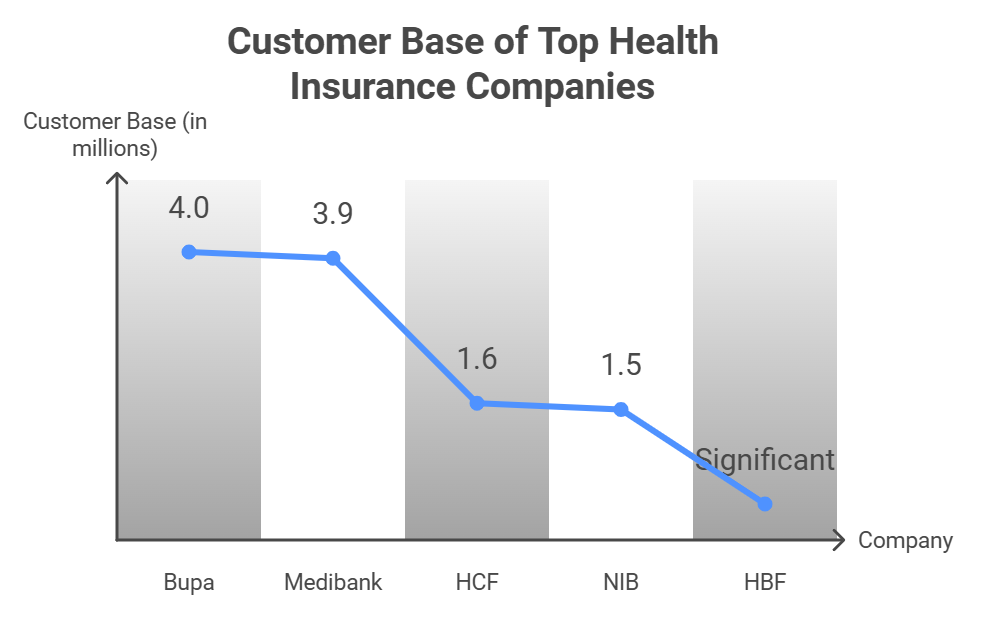

Top 5 Health Insurance Companies in Australia Steadfast Marine

Australia’s healthcare market is guided by leading health insurance companies. They supply various products and services for people and families. HBF, NIB, Medibank, Bupa and HCF are among the top providers.

Bupa is a global leader in Australia. It offers flexible coverage and a wide network of providers. It’s great for maritime workers who need quality healthcare.

Medibank is well-known, serving over 3.9 million. It’s famous for its wide coverage and network of healthcare providers. It’s a top pick for maritime workers.

HCF is Australia’s largest not-for-profit insurer, with over 1.6 million customers. It’s famous for its adaptable rules and not-for-profit approach. It stands out in the market.

NIB is growing fast, with over 1.5 million customers. It’s known for being affordable and accessible. NIB has policies for maritime workers, covering many medical needs.

HBF insurer has a legacy of over 80 years and focuses on providing a variety of health insurance products that include private hospital care, medical service coverage, and health discounts.

These top providers offer tailored solutions for maritime workers. They ensure access to quality healthcare, whether at home or at sea.

| Rank | Company | Customer Base | Strengths |

|---|---|---|---|

| 1 | Bupa | Over 4 million | Global expertise, extensive local care network |

| 2 | Medibank | Over 3.9 million | Comprehensive coverage, wide provider network |

| 3 | HCF | Over 1.6 million | Flexible, tailored policies, not-for-profit model |

| 4 | NIB | Over 1.5 million | Affordable and accessible health insurance |

| 5 | HBF | Significant | Private hospital care, medical service coverage, discounts |

Maritime workers can pick the best health insurance by looking at what each provider offers. They should also check customer satisfaction ratings.

Comparing Costs and Coverage Options

The selection of health insurance providers in Australia is quite a big decision. One must analyze the costs and options for coverage to figure out what best fits your needs and budget. All this encompasses monthly premiums, deductibles, co-payments, and policy limits. More expensive policies might offer better protection by covering more services and reducing your costs.

Basic or lower-cost health insurance plans might be better for those with fewer health needs. By weighing premiums and coverage, you can pick a policy that’s good value and meets your needs.

Balancing Premiums and Out-of-Pocket Expenses

When examining health insurance prices in Australia, think about both premiums and out-of-pocket expenses. Full-cover plans might require more money but possibly help save on deductibles and co-payments. These options are suitable for people with ongoing or complex medical problems. Alternatively, budget-friendly medical plans with smaller premiums might suit those with fewer health needs.

- Find the right balance between premiums and out-of-pocket expenses for your situation.

- Think about the trade-offs between comprehensive policies and basic policies to get the best value.

- Consider your healthcare needs and budget to choose the affordable medical plan that’s right for you.

Considering Individual and Family Needs

You must think of your personal health needs and those of your family members when choosing a health insurance provider in Australia. Coverage varies depending on age, health, family size, and life stage.

Younger people or couples might focus on affordable, basic plans. But families with kids or those with health issues need more. They need plans that cover preventative care and can be tailored to their needs.

- Examine your life situation and future health needs: Are you living alone, beginning a family or thinking about retirement?

- Think about any current health issues that might need special treatment or regular care.

- Determine how much coverage you would need by weighing the difference between the premiums and your out-of-pocket costs.

- Emphasize wellness programs that support health services for your long-term fitness.

- Look for insurers offering flexible, customizable policy choices for your specific needs.

By looking at your and your family’s specific needs, you can find the right health insurance. This approach ensures you get the coverage and cost that fits your situation. It helps you stay healthy and well.

“Investing in the right health insurance plan is not a one-size-fits-all decision. It’s about finding a policy that truly aligns with your personal and family’s unique healthcare requirements.”

Regulatory Framework and Approvals

The Australian private health insurance industry follows strict rules to keep consumers safe. It keeps the financial stability of insurance providers.The government is responsible for collaborating with other bodies, like PHIO and APRA, to design and enforce the rules and regulations.

Government Oversight and Consumer Protection

APRA focuses on the financial health of insurers and enforces rules to protect customers. The PHIO is an independent body that helps solve customer complaints and looks into industry issues. This setup gives consumers confidence in the health insurance providers in Australia.

The Australian health insurance regulation is backed by the Private Health Insurance Act. This act sets out consumer protection guidelines and ensures the government watches over insurers. With APRA supervision and the PHIO, the system focuses on the well-being of Australians. It aims to make healthcare coverage affordable and reliable.

| Regulatory Authority | Key Responsibilities |

|---|---|

| Australian Prudential Regulation Authority (APRA) | Supervising the financial health of insurers Enforcing prudential rules to protect consumer benefits |

| Private Health Insurance Ombudsman (PHIO) | Resolving customer complaints Investigating industry-wide issues |

The strong government oversight of insurers and consumer protection guidelines in Australia’s private health insurance sector boost confidence. It ensures Australians can rely on affordable and reliable healthcare coverage.

Choosing the Right Health Insurance Provider

Finding the best health insurer in Australia means looking at coverage, costs, customer service, and approvals. Rankings and market share give a basic idea. But, it’s important to really understand what each insurer offers.

When looking at coverage and costs, think about what’s included and how you can tailor it. Knowing the regulatory framework and approvals helps ensure the insurer is trustworthy and stable.

Customer reviews can show how good a health insurer is. Look for policies that cover what you need, like regular check-ups and emergency care. This way, you can feel secure about your health insurance.

Do your homework, compare, and choose based on your needs. This way, you get a policy that’s both valuable and protective for you.

| Insurer | Coverage Highlights | Customer Satisfaction | Regulatory Approval |

|---|---|---|---|

| NIB | Affordable and accessible health coverage | 4.6 out of 5 stars | Regulated by APRA and the Australian Securities and Investments Commission (ASIC) |

| Medibank | Comprehensive coverage and extensive provider network | 4.4 out of 5 stars | Approved by APRA and ASIC |

| Bupa | Global expertise and local care | 4.3 out of 5 stars | Regulated by APRA and ASIC |

| HCF | Flexible and tailored health insurance policies | 4.2 out of 5 stars | Approved by APRA and ASIC |

| HBF | Private hospital care, medical service coverage, and health discounts. | 4.1 out of 5 stars | Approved by the Australian Prudential Regulation Authority (APRA) |

By carefully looking at these factors and comparing, you can choose the best health insurance for you or your family.

Check Top 10 Insurance Companies in Philippines with our expert guide.

Conclusion

Australia has different health insurance companies. Big ones are Medibank, Bupa, HCF, NIB and HBF. They have many choices. Selecting a plan needs thought about cost and how much it covers. Also, consider how good their customer help is and if they follow rules properly.

Study and compare before picking a health insurance. Know what the rules protect and choose one that suits your health needs and values. Medibank, Bupa, HCF, NIB and HBF have many plans and care about customer well-being. You probably feel confident taking care of your health with good support.

FAQ

What are the five best health insurance providers in Australia?

Top five health insurance companies that one can look for here include HBF, NIB, Medibank, Bupa and HCF.

How does Medicare work with other components of the Australian health system?

Medicare is the universal public medical coverage system within Australia. In it, care from general practitioners and surgeons is mostly subsidized and very affordable or available at no charge. At a public hospital, however, one does not even need to pay.

In what way does private health insurance complete Medicare in Australia?

Australian private health insurance benefits beyond those covered by Medicare, which include dental services and physiotherapy services; additionally, it offers flexibility on choosing the hospital to use and your personal doctor.

What are the main features of NIB’s health insurance plans?

NIB is noted for being affordable and accessible. It presents clear, value-oriented health insurance choices. Clients select from basic hospital cover, extras cover or both.

What differentiates Medibank in the Australian health insurance market?

Medibank offers numerous varieties of health insurance. It offers products for singles, couples, families, and seniors. It has family cover with strong benefits for maternity and kid’s health services.

How does Bupa’s global knowledge benefit its Australian health insurance clients?

Bupa’s global knowledge brings thorough health insurance solutions. It covers regular healthcare needs and complex medical care. Bupa is recognized for its good extras cover and wellness services.

What is special about HCF’s method to health insurance in Australia?

HCF is the largest not-for-profit health insurer in Australia. It uses its profits to give better benefits and services. HCF’s plans are adaptable, letting clients adjust their cover according to their needs and budget.

What factors should I take into consideration in deciding on a health insurance company in Australia?

What is to be considered when determining which health insurance provider to choose? The monthly contributions, deductibles and out-of-pocket expenses. Consider the coverage choices and customer support. Assess your own or your family’s needs, like age and health, to find the best balance of coverage and cost.

How is the Australian private health insurance sector regulated?

The government regulates the private health insurance sector in Australia. Laws and groups like APRA and the PHIO protect financial stability and consumers. This ensures trust in the honesty and dependability of health insurance providers in Australia.

1 thought on “Latest Top 5 Health Insurance Companies In Australia Steadfast Marine”