Did you know that the cost for a universal life insurance direct Canada is usually between $100 to $125 per year? This shows how affordable this permanent life insurance is. It is a good option for most Canadians. In this article we will outline its main features, its mechanism of working, advantages and disadvantages, and for whom it may be of benefit. Expert guide insurance provide proper details about every type of insurance.

Key Takeaways

- Universal life insurance lets you change premiums and death benefits within limits. This makes it flexible.

- It allows you to invest 100% of your savings in indexes outside Canada. This includes S&P Indexes and more.

- It offers creditor protection if set up right. This is key for business owners worried about lawsuits.

- Universal life insurance grows tax-free, like an RRSP. You won’t pay income tax on growth within the policy.

- It avoids probate fees if set up correctly. This means your investment and policy value go tax-free to your beneficiary.

What is Universal Life Insurance?

Universal Life is one of the types of permanent life insurance, which includes a combination of life insurance and a savings element. Its premiums and death benefits are more flexible than whole life insurance.

The policyholder can change his premium payments and coverage. This depends on his changing needs and financial situation.

Key Features of Universal Life Insurance

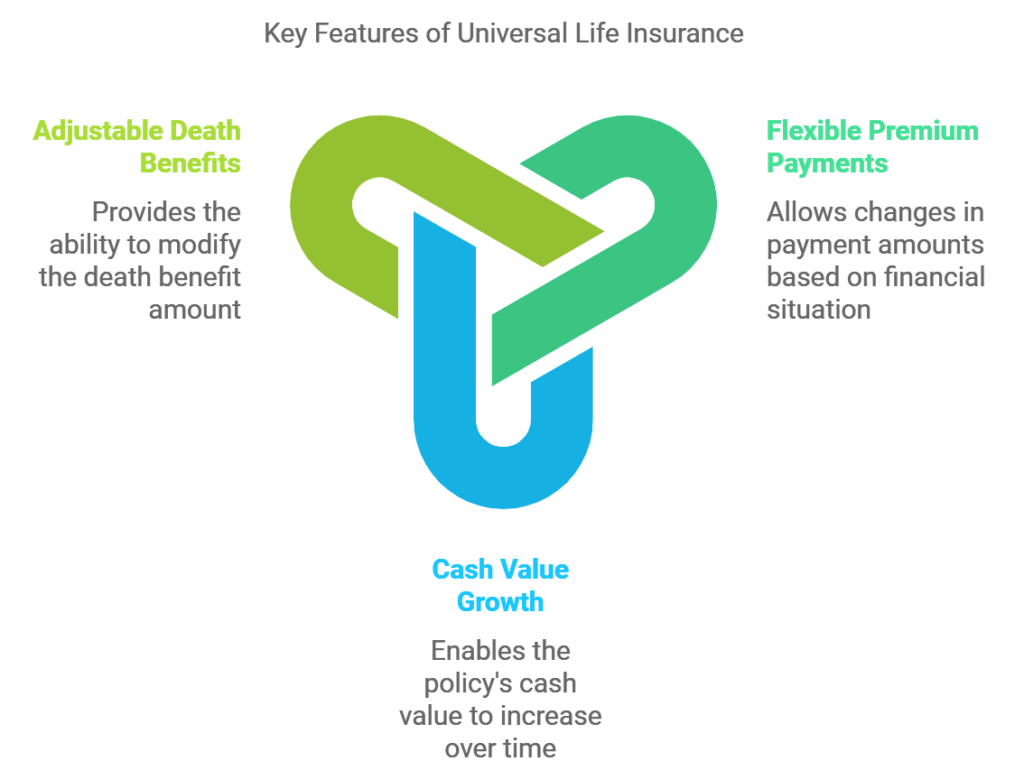

Some key features of universal life insurance include:

- Flexible Premiums: Policy owners can change how much they pay within set limits. They can pay more, pay less, or even skip payments when they need to.

- Flexible Death Benefits: The amount paid out when someone dies can go up or down. This depends on health checks and what the policy allows.

- Cash Value Growth: Some of the money paid goes into a savings account. This account grows without being taxed right away. Policy owners can take money out or borrow from it.

- Investment Choices: The savings can be put into different types of accounts. These include fixed accounts or ones that follow market indexes giving chances for the money to grow.

Flexible Premiums and Death Benefits

Universal life insurance gives you some wiggle room with flexible premiums and payouts when you die. You can change how much you pay, within certain limits. This means you can pay more, less, or skip payments altogether, depending on your money situation.

The death benefit can also be adjusted. This is subject to underwriting requirements and policy limitations.

This flexibility is useful for those with changing income or financial needs. It lets them tailor their life insurance coverage to their evolving circumstances.

How Does Universal Life Insurance Work?

Universal life insurance is a special policy that offers both life insurance and a chance to invest. It has two main parts: the cost of insurance (COI) and the cash value part.

Cost of Insurance (COI) and Cash Value Components

The price for insurance (COI) covers the life insurance portion. Your age, health, and desired coverage amount determine this cost. The cash value component allows you to invest and potentially increase your money as time passes.

Your premium payments split between the COI and the cash value. You have options to use the cash value to cover future premiums, borrow against it, or boost your death benefit.

| Age & Gender | Annual Premium for $1M Guaranteed Universal Life |

|---|---|

| 30-year-old Female | $3,539 |

| 60-year-old Male | $14,647 |

Universal life insurance lets you change your coverage and payments as your needs change. But remember, the cash value might not grow as expected, and policy charges can affect its value.

“Consumers are cautioned against buying indexed universal life insurance due to misleading sales practices, with a warning issued in July 2020 by the Center for Economic Justice advising consumers against purchasing such policies.”

It’s key to understand how universal life insurance works, including the cost of insurance and cash value parts. This type of coverage is flexible but needs careful thought about its risks and benefits.

Advantages and Disadvantages of Universal Life Insurance

Universal life insurance offers flexibility but also has trade-offs. It’s key to understand these points to decide if it fits your financial needs.

Advantages of Universal Life Insurance

- Flexible premium payments: You can change your payments as your money situation changes. This is great for when your income goes up or down.

- Potential for cash value growth: The cash value part of your policy can grow. This can give you extra money or help pay future premiums.

- Adjustable death benefits: You can change how much your policy pays out when you die. This gives you more control than traditional policies.

Disadvantages of Universal Life Insurance

- Complexity: Universal life insurance is more complex than other types. It’s important to understand it well to avoid surprises.

- Potential for lapse: If your policy’s cash value isn’t enough, it might lapse. This means your loved ones could lose the death benefit.

- Fees and charges: There are many fees with universal life insurance. These can include administrative costs and higher expenses than term life.

Choosing universal life insurance depends on your financial goals and risk comfort. Talking to a financial advisor can help you make the right choice for you.

| Advantages | Disadvantages |

|---|---|

| Flexible premium payments | Complexity |

| Potential for cash value growth | Potential for lapse |

| Adjustable death benefits | Fees and charges |

“The flexibility of universal life insurance can be both a blessing and a curse. It’s important to carefully weigh the pros and cons to ensure it aligns with your long-term financial objectives.”

Knowing the good and bad of universal life insurance helps Canadians decide if it’s right for them. Always get advice from a financial expert before making big financial choices.

universal life insurance direct Canada

In Canada, many insurance providers offer universal life insurance directly to people. This means Canadians can buy coverage without needing an agent or broker.

Some big direct life insurance providers in Canada are:

- IDC Insurance

- Manulife

- Sun Life Financial

- RBC Insurance

- Empire Life

These companies give direct life insurance quotes. They also let Canadians buy Canadian life insurance online direct. This makes it easy to get universal life insurance coverage.

Getting direct life insurance in Canada can save money. Without an agent, these providers can offer better direct life insurance quotes.

“IDC Insurance has successfully assisted over 15,000 clients in Canada with obtaining the best rates on life, travel, and mortgage insurance.”

When looking at universal life insurance direct Canada, it’s key to compare different providers. This ensures you get the best coverage at good rates. Talking to financial advisors can also help you understand direct life insurance in Canada better. They can help you choose what’s best for you.

Universal Life Insurance vs Term Life Insurance

When looking at universal life insurance and term life insurance, there are important differences. Knowing these can help you choose the best life insurance for you.

Key Differences Between Universal and Term Life

- Coverage time: Term life insurance provides protection for a specific time, like 10 to 30 years. Whole life insurance insures throughout your entire life.

- Cash component – Universal life insurance gathers a cash part that increases over years. Term life insurance lacks this part.

- Flexibility: Universal life insurance lets you adjust payments and payout amounts. Term life insurance has fixed values and costs.

- Cost: Term life insurance costs less, which is perfect for younger individuals. For example, a non-smoking woman aged 40 gets $500,000 in protection for just $22.44 monthly.

Choosing between universal life insurance and term life insurance depends on your financial goals and budget. It’s key to weigh the pros and cons of each to find the right fit for you.

“Term life insurance is a more affordable option for those who need coverage for a specific period, while universal life insurance provides the flexibility of lifelong protection and a cash value component.”

Universal Life Insurance vs Whole Life Insurance

Both universal life insurance and whole life insurance are permanent life insurance options. They have different features and benefits. Knowing the difference can help you to choose the right policy that will cater to your financial goal and protection needs.

Universal life is more flexible. You can modify your payments and death benefit as your need changes over time. On the other hand, whole life insurance has fixed premiums and a set death benefit that doesn’t change.

The cash value component is another key difference. Both policies build up cash value over time. But, universal life insurance might grow faster because of investments in indexed or variable subaccounts.

| Feature | Universal Life Insurance | Whole Life Insurance |

|---|---|---|

| Premiums | Flexible | Fixed |

| Death Benefit | Flexible | Fixed |

| Cash Value Growth | Potential for higher growth through investments | Conservative, guaranteed growth |

The difference between universal life insurance and whole life insurance in Canada is mainly based on financial needs and preference. Universal life insurance is preferable to those people who want to adjust the coverage and premiums. Whole life insurance is better for those who like fixed payments and guarantees death benefits.

“The choice between universal life insurance and whole life insurance comes down to your financial goals and risk tolerance. Understand the key differences to make the best decision for your unique circumstances.”

A good financial advisor is very important. They can help you choose the right policy. This policy should offer the best balance of protection, flexibility, and long-term value.

Types of Universal Life Insurance

In Canada, there are many types of universal life insurance. Each one has its own special features and benefits. They meet the different needs and financial goals of people. Let’s look at the main types of universal life insurance:

Guaranteed Universal Life Insurance

Guaranteed universal life insurance pays a death benefit guaranteed for a specific period or age, such as 90 or 100. These policies usually don’t have much cash value. They are cheaper for people who want long-term coverage.

Indexed Universal Life Insurance

Indexed universal life insurance allows the modification of premiums and death benefits. It also acquires cash value. Cash value is calculated by the market index, such as the S&P 500. You earn from equity markets, but you will not incur any losses.

Variable Universal Life Insurance

Variable universal life (VUL) insurance allows individuals to oversee their investments, similar to a variable annuity. This gives greater control over cash value growth. However, there is a risk since the policy’s success relies on one’s investments.

Picking the suitable universal life insurance depends on one’s financial needs, the level of risk that is acceptable and long-term aspirations. Speaking with a knowledgeable insurance expert might support the search for the best choice.

Who Should Consider Universal Life Insurance?

Universal life (UL) insurance is good for many Canadians. It depends on their financial needs and goals. Here are some people who might find UL useful:

- Investors Aged 40 or Older: UL and whole life policies are best for those over 40. They offer long-term coverage and cash value growth.

- Canadians Seeking Flexible Premiums: UL insurance lets you change premiums within limits. This is different from whole life policies with fixed premiums.

- Those Wanting to Enhance Retirement Income: The cash value in a UL policy can be used for loans. This can help with retirement income if needed.

For instance, Mr. Sanders bought a UL policy at 50 with a $500,000 death benefit. He planned to add $15,000 each year for 15 years. This was better than investing in GICs earning 5 percent.

After the first year, his policy gave his beneficiaries about $509,801. This was $494,379 more than the GIC option if he had died. After 35 years, the policy could give his children about $790,837 tax-free. This was $297,795 more than the GIC option.

It’s key to talk to professional advisors before getting insurance. They can help make sure it fits your financial goals and situation.

Factors to Consider When Buying Universal Life Insurance

When you buy universal life insurance in Canada, there are important things to think about. The costs and fees, and how the cash value can grow, are key. These factors help figure out the policy’s long-term value.

Policy Costs and Fees

Universal life insurance policies have fees and charges that affect the cost. These can include:

- COI charges: These typically are age, health, and risk-based, therefore rise as one gets older.

- Administrative charges: These represent all the administrative costs that the insurance company has to incur on your policy. They may include running your policy or keeping records.

- Investment management charges: In case you have a policy that’s invested, then there’ll be a charge to pay for managing investments.

It’s important to understand these costs. This ensures the policy fits your budget and financial goals.

Cash Value Growth

Universal life insurance has a big plus: the chance for cash value to grow. The cash value part of your policy can grow if invested. But, how much it grows depends on:

- Investment performance: The returns from the investments in your policy.

- Market conditions: Market ups and downs can affect your cash value growth.

- Policy management: Keeping your policy well-managed to maintain coverage and cash value growth.

Thinking about these factors helps you see how much your cash value might grow. This helps you decide if the policy fits your financial goals.

“Universal life insurance is a versatile product, but it’s important to understand the costs and risks involved to ensure it’s the right fit for your needs.”

By looking at policy costs, fees, and cash value growth, you can make a smart choice. This ensures your universal life insurance policy in Canada meets your financial and protection needs.

Conclusion

In conclusion, universal life insurance is a valuable tool for Canadians. It offers flexible premiums and the chance for cash value growth. This makes it a unique choice for both protection and investment.

If you want to boost your retirement savings or reduce taxes, universal life insurance might help. Financial security helps to protect your family for the long-term. With options like universal life insurance direct Canada and universal life insurance Toronto, you can find the right policy for you.

When looking into life insurance universal life insurance, consider its pros and cons. Think about how to use the cash value, like direct withdrawal or policy loans. With the right knowledge, universal life insurance direct Canada can help you achieve a secure future for your loved ones.

For further reading and a deeper dive into the specifics of Universal Life Insurance in Canada, including case studies and detailed comparisons, you can visit the comprehensive guides available at sites like GoodCaring, LifeBuzz, and BestInsuranceOnline.

FAQ

What is universal life insurance?

Universal life is a type of permanent life. It has flexible premiums and can grow in cash value.Unlike whole life, you adjust premiums and death benefits within limits.

What are the key features of universal life insurance?

It holds two main sections: the cost of insurance (COI) and cash value. It carries both good and bad points for Canadians to ponder.

How does universal life insurance operate?

It mixes life insurance with a savings part. The policy has COI and cash value parts.

What are the pros and cons of universal life insurance?

It has both good and bad sides for Canadians to consider.

What is universal life insurance direct Canada?

In Canada, some providers sell universal life insurance directly. This means Canadians can buy it without an agent or broker.

How would you differ universal from term life insurance?

There is a couple of differences about the universal life insurance and the term one.

How different is it between the whole life from the universal one?

Universal and whole life insurance are both permanent. But they have some key differences.

What types of universal life insurance exist in Canada?

Canada offers many universal life insurance types. Each has its own features and benefits.

Who should consider universal life insurance?

Many Canadians might find universal life insurance useful. It depends on their needs and goals.

What factors should I consider when buying universal life insurance?

When buying, think about policy costs, fees, and cash value growth. These are important to consider.