Did you know life insurance protects over 75% of American families? It helps them avoid financial disaster when a loved one passes away. This guide will help you understand life insurance well. Unlocking The Secrets Of Life Insurance Comprehensive Guide. You’ll learn about different policies, coverage, and how to get the right policy for your family in 2024 and later.

This article will cover term, whole, and universal life insurance. You’ll also learn about policy riders and how to file claims. Your key is that to understanding the life insurance. Protect your family future financially our expert guide you.

Understanding Life Insurance: A Vital Investment

Life insurance always protect your life and provide you security. This is the deal with you of your company. They promise to pay a set amount to your chosen beneficiaries if you pass away. This simple idea can greatly impact the lives of those you love.

What is Life Insurance?

There is an option that ensures the safety and security of your family and their finances. Death insurance helps your near ones to afford what they are supposed to be living their lives trying to afford. It facilitates settlement of liabilities, payment of funeral expenses, etc. A death policy is not only defensive when it comes to your family, it is also internal comfort and financial assurance.

Why is Life Insurance Important?

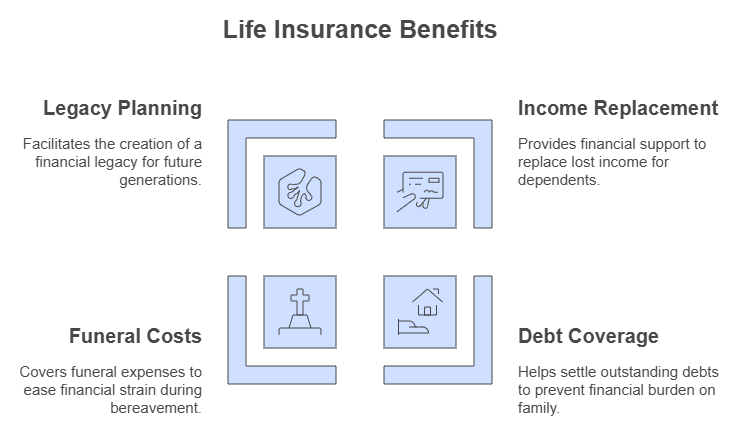

- Income Replacement: Life insurance can function as indemnity coverage meaning it can take the place of any salary that you would have generated and given to your family so as to assist them in sustaining their way of life and attending to their necessary needs.

- Debt Coverage: Life insurance enables one to settle loans that are still due such as mortgaged houses or car loans so that the family is able to incur such expenses.

- Funeral Costs: Life insurance can be very helpful in financing the costs required when one dies and in costs such as burial, so that it does not put more pressure on the family in those hard times.

- Legacy Planning: A direct purpose of having life insurance coverage in place is to utilize these funds in order to leave an estate for your children’s education, philanthropic efforts, and others monetary purposes.

Life insurance offers a family financial protection and hence the decision to invest in this area must be thought of as an investment which will benefit your family in the long run. But, by learning life insurance value and what life insurance is, you can protect the financial future of your loved ones no matter what life brings.

Types of Life Insurance Policies

If you start looking at life insurance, you will see many kinds. All having its own financial needs and personal choices. Understanding the Differences Between Term and Whole/Universal Life But because term life insurance is incredibly popular, and for good reason.

Life insurance is a protective guard for some time, say 1 to 30 years. But if you are in urgent need or looking for a cost-effective solution for now, it can help.

Whole life insurance gives lifelong coverage. It has a guaranteed death benefit and can grow in value. It’s a solid choice for those wanting a long-term financial tool.

Universal life insurance is flexible and customizable. You can adjust premiums and death benefits as your needs change. It offers control and adaptability for life.

“Providing security to the future of your loved family, not just their life.”

Be honest with who you are and what you can afford to choose the most appropriate life insurance for your lifestyle and financial situation before making a decision. Also, if you are doing MBA then think of which long term goals it fits into. Once you realize that, then you have the ability to figure out which balance of coverage, pricing, and openness best fits your needs.

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

Term Life Insurance: Affordable Protection

The most affordable life insurance is typically term life. These offer protection for a specific period of time, typically anywhere from 1 to 30 years. It is a favorite for many: your loved ones gets a payout if you die during this time.

How Term Life Insurance Works

Term life insurance covers you for a certain period. You pay a fixed amount each month to keep the policy active. The payout to your family if you die is also set beforehand. This policy only lasts as long as you choose, and then it ends unless you renew or change it.

Pros and Cons of Term Life Insurance

Term life insurance has its good and bad sides. Here are the main points:

- Affordability: It’s the cheapest life insurance, making it easy to get for many people.

- Flexibility: You can pick how much coverage you need and for how long, fitting it to your life.

- Temporary Coverage: It’s only good for a set time, not forever, which might not be what everyone wants.

- Expiration: When the term ends, you have to renew or change it to keep coverage.

When looking at term life insurance, think about what’s best for you. Knowing how term life insurance works and its pros and cons helps you choose wisely. This way, you can protect yourself and your family.

Whole Life Insurance: Lifelong Coverage

Whole life insurance offers permanent coverage and the chance to grow cash value. Whole life insurance protects you for life, ensuring your loved ones are cared for whenever needed.

It comes with a guaranteed death benefit When you die, as long as you continue to pay the premiums they provide the total death benefit to your family. It gives some financial security, knowing your family will be looked after.

Whole life insurance similarly has a cash-value component. This money all can be used for loans or withdrawals. This is a source of funds for emergencies, retirement or other aspirations. Growth is tax-free: The growth allows your savings to grow without taxes.

This is viewed as a life long investment because it provides protection as well as savings. Premiums are higher, but policyholders seek security and the long-term benefits with cash value at maturity.

Whole Life Insurance: Consider Needs, Budget, and Goals So, discuss with a reliable insurance agent to get the suitable policy for yourself. They make sure your policy fits exactly to your circumstances.

Universal Life Insurance: Flexibility and Customization

Universal life is a type of life insurance in and over itself. Flexible and Customized That is different than what most traditional life or term life insurance offers. You can create your coverage to suit you and your budget.

Understanding Universal Life Insurance

Universal life insurance is a permanent life insurance. It has a death benefit and a cash value part. Unlike fixed whole life policies, you can change your premiums and coverage as your needs change.

This flexibility is great when your financial situation or family changes.

Benefits of Universal Life Insurance

- Adjustable Premiums: You can adjust your premium payments. This lets you fit your budget and financial goals.

- Flexible Coverage: You can also increase or decrease your death benefit. It is beneficial for a more extensive family or upgrade your economic commitments.

- Cash Value Accumulation: The cash value on your policy may grow over time. It is the source to earn money for any emergencies or any of your financial needs.

- Tax-Deferred Growth: The cash value of your policy grows tax-free. This can boost your investment growth in the long term.

“As your life and financial needs change over time, universal life insurance offers a level of flexibility and customization that can be extremely valuable.”

You can determine if universal life insurance is right for you by being aware of its special features.

It’s about finding the life insurance that meets your benefits of universal life insurance.

Unlocking The Secrets Of Life Insurance Comprehensive Guide in 2024

This guide offers valuable insights and practical knowledge. It is designed to help you take control of your life insurance choices.

From life insurance through picking policy types and benefits, this guide is chock-full of topics. You will understand life insurance protection for your loved ones and saving for the future.

You’ll learn what to look for in life insurance. These include your age, health, family situation, and financial goals. With this knowledge, you can pick the right policy for your needs.

The guide also explains the application process, underwriting, and policy management. It gives you the tools to navigate the life insurance world easily. This way, you can make smart choices and keep your policy valuable over time.

Unlocking life insurance secrets in 2024 is a journey to a secure financial future. This guide is your roadmap. Dive in and discover how to protect your loved ones and secure your legacy.

“Life insurance is not just a policy, it’s a promise to those you love.” – Anonymous

Determining Your Life Insurance Needs

Read on to discover why the right life insurance is crucial for your family’s financial future. Do you consider at your debts right now, dependents and future goals. As best I can tell. So that your life insurance is for the real need of what your family needs.

Factors to Consider

Life insurance then you must loo at these points for yourself.

- Your current and future financial obligations like mortgage payments, outstanding debts, and childcare expenses.

- The number of dependents you have, including children, spouses, and elderly parents.

- Your income and how its absence will affect your family’s way of life if you were no longer here.

- Your retirement goals and the necessity of the development of your family’s long-term financial guarantee.

- Other life insurance policies, such as employer-provided schemes and any other potential ways to meet your needs.

Life Insurance Calculators

Online life insurance calculators can help find the right coverage. They look at your age, income, and dependents. This way, they suggest a policy that protects your family’s finances.

Remember, you want a policy that protects your family without breaking the bank. By thinking about these factors and using calculators, you can find the best policy for your situation.

Choosing the Right Life Insurance Policy

Choosing the right life insurance plan might feel tough but it’s very important for keeping your family safe in the future. It is up to the family leader to protect loved ones no matter what. Comparing different policy options becomes necessary because family members depend on the departed to have set things right.

Comparing Policy Features

Life insurance has key parts to think about when choosing

Coverage Limits: How much protection does your family need for their money needs?

Premiums: Look at monthly or yearly costs and find a plan that matches your spending.

Riders: Explore extra coverage like disability or critical illness riders to expand what your policy covers.

Working with an Insurance Agent

Picking a life insurance plan seems confusing, but having a helpful insurance agent improves understanding. A knowledgeable agent assists in determining your needs, looking at different policy details, and finding the most suitable plan. Don’t agents offer useful tips to guide you toward a wise decision?

“A good insurance agent will take the time to understand your unique financial situation and help you find the right coverage to protect your family’s future.”

Choosing good life insurance matters for your family’s money security. How do you find the best option? Look at different plans and talk to a trusted insurance expert. This approach helps get the policy that suits your needs. Peace of mind follows.

Life Insurance Riders and Additional Coverage

Starting your life insurance journey means learning about riders. These are extra features you can add to your policy. They offer more protection and coverage options. By looking into life insurance riders, you can make your coverage fit your needs. This ensures your loved ones are safe.

The accidental death and dismemberment (AD&D) rider is a popular choice. They give you extra payment if you die or you had a accident. The waiver of premium rider is another favorite. It lets you skip paying premiums if you get disabled and can’t work.

- Life insurance riders can enhance your coverage and provide additional protection:

- Accidental death and dismemberment (AD&D) rider

- Premium rider of waiver

- Long-term care rider

- Critical illness rider

- Child rider

Some extra options are the long-term care rider and the critical illness rider. The long-term care rider helps cover costs when you need long-term care services. The critical illness rider gives a big payment if you learn you have a really bad illness. The child rider increases protection for your kids, keeping them safe too.

“Life insurance riders can significantly enhance your coverage and provide additional financial protection for you and your loved ones.”

Understanding different life insurance riders helps you tailor your policy. This way your family receives the top life insurance protection. Speak with your insurance agent to discover suitable riders for you and your family.

Applying for Life Insurance: Step-by-Step Guide

Applying for life insurance can seem hard, but it’s easier with the right prep. Whether it’s your first time or you’re updating your coverage, knowing the steps helps. It makes the process feel less scary and more manageable.

Preparing for the Application Process

The first thing to do is gather all the needed info and documents. This includes your personal and medical history, job details, and financial status. Having these ready makes the application go faster and smoother.

- Get your personal info like name, birthdate, and Social Security number.

- Know your medical history, current or past health issues, and any medications.

- Tell about jobs, income, and financial stuff.

- Have copies of important papers like driver’s license, pay slips, and medical records ready.

Underwriting and Approval

After you apply, the insurance company begins underwriting. This step checks your risk and chooses your coverage and costs. Maybe you’ll need a medical exam or more info to help your application.

The insurer looks at your application and evaluates risk factors like age, health, and lifestyle.

You may give extra details or have a medical exam to assist the insurer in deciding on your eligibility and coverage.

After underwriting, the insurer tells you if they approve your application or need more info.

If approved, expect policy documents showing coverage details and your payment amount.

Life insurance application steps vary with each company and policy. Knowing the steps helps you get ready and maybe make the process easy and successful. Investopedia provide all the information about it.

Life Insurance Management

Taking care of your life insurance is crucial to help your family. Learn about updating your policy. This involves changing who benefits or how much coverage you have. Checking your policy regularly keeps it in line with life events like marriage or having kids.

Pay premiums on time. Setting up automatic payments or reminders helps keep insurance active. Understand your policy’s cash value and when to use it.

Life insurance should evolve with you. By taking care of it, you help your family and keep your investment strong. Does it serve its purpose even after many years?